Top-Rated Finance Apps for Freelance Income Management

Top-rated finance apps for freelance income management are revolutionizing how freelancers handle their finances. Successfully navigating the complexities of self-employment requires meticulous financial organization, a challenge often exacerbated by the lack of traditional employer-provided benefits and structures. This guide explores the best apps to streamline income tracking, expense management, invoicing, and tax preparation, ultimately empowering freelancers to take control of their financial well-being.

Freelancers face unique financial hurdles, including irregular income streams, managing multiple clients, and the responsibility for self-employment taxes. Efficient financial management is crucial for profitability and long-term financial security. Utilizing specialized finance apps offers several key advantages: streamlined accounting processes, improved cash flow visibility, and reduced administrative burden, allowing freelancers to focus more on their core competencies and less on tedious bookkeeping.

Introduction: Top-Rated Finance Apps for Freelance Income Management

Freelancing offers flexibility and autonomy, but effective financial management is crucial for success. Without careful tracking of income and expenses, freelancers risk overlooking tax obligations, mismanaging cash flow, and ultimately, jeopardizing their financial stability. This necessitates a proactive approach to financial organization, particularly given the irregular income streams often associated with freelance work.Freelancers face unique financial challenges. Income can fluctuate significantly from month to month, making budgeting difficult.

Managing freelance income effectively requires the right tools, and several top-rated finance apps excel at this. Finding the perfect app often involves exploring various options, which is why understanding the broader landscape of Finance Apps is beneficial. Ultimately, selecting the best app depends on your specific needs, but many cater specifically to the unique financial demands of freelance work.

They are also responsible for self-employment taxes, which can be a considerable expense. Furthermore, managing invoices, tracking expenses for tax deductions, and securing adequate health insurance are all responsibilities that require diligent attention and organization. The lack of employer-provided benefits further complicates the financial landscape for independent workers.

Benefits of Using Finance Apps for Freelance Income Management

Utilizing finance apps offers several key advantages for freelancers. These tools streamline the financial management process, leading to increased efficiency and improved financial health. Specifically, finance apps enhance organization, improve accuracy, and provide valuable insights into financial performance.

Popular App Categories

Freelancers require specialized financial tools to manage their unique income streams and expenses. Three major categories of apps effectively address these needs: accounting apps, invoicing apps, and budgeting apps. Each category offers distinct features designed to streamline various aspects of freelance finance. Understanding their strengths and weaknesses is crucial for selecting the right tools for optimal financial management.

Accounting Apps, Top-rated finance apps for freelance income management

Accounting apps provide a centralized system for tracking income and expenses. They offer features like expense categorization, profit and loss reports, and tax preparation assistance. Many integrate with other financial tools, allowing for seamless data transfer. A strong accounting app simplifies tax preparation by providing organized records of all financial transactions. For example, an app might automatically categorize expenses based on s in transaction descriptions, saving significant time and effort compared to manual record-keeping.

However, some apps might have a steeper learning curve, especially for those unfamiliar with accounting principles. The level of customization and reporting features can also vary significantly across different apps.

Invoicing Apps

Invoicing apps are essential for freelancers to generate professional invoices and track payments. Key features include customizable invoice templates, automated payment reminders, and integration with payment gateways. These apps simplify the invoicing process, ensuring timely payments and reducing administrative overhead. For instance, an app could automate the sending of invoices on a recurring schedule, eliminating the need for manual intervention.

This ensures consistent cash flow and reduces the risk of late payments. However, some apps may charge transaction fees or subscription fees, which can impact profitability, especially for freelancers with a low volume of invoices. The level of customization in invoice design might also be limited in some free or basic versions.

Budgeting Apps

Budgeting apps help freelancers track their income and expenses to manage cash flow effectively. They provide features like expense tracking, budgeting tools, and financial forecasting. These apps aid in identifying areas for potential savings and improving financial planning. For example, a budgeting app could provide a visual representation of spending habits, highlighting areas where expenses exceed the budget.

This visual data can facilitate informed decision-making about spending priorities. However, the effectiveness of budgeting apps relies heavily on consistent data entry. Inaccurate or incomplete data can lead to flawed financial projections. The level of sophistication in forecasting and financial analysis can also vary greatly between different apps.

Top App Features for Freelancers

Managing finances as a freelancer requires dedicated tools. Choosing the right app can significantly streamline your workflow, improving accuracy and saving valuable time. The features offered by various apps can vary widely, impacting their suitability for your specific needs. This section will examine key features offered by popular finance apps and compare their functionality.

Top Finance App Feature Comparison

Selecting a finance app hinges on its ability to effectively manage various aspects of your freelance business. The following table compares five leading apps based on key features crucial for freelancers. Note that pricing models can change, so always verify directly with the app provider.

| App Name | Key Features | Pricing |

|---|---|---|

| FreshBooks | Invoice creation, expense tracking, time tracking, client management, reporting, basic accounting features. Offers integrations with other business tools. | Subscription-based, with various plans offering different feature sets and user limits. |

| Xero | Comprehensive accounting software including invoicing, expense tracking, bank reconciliation, payroll (in some regions), reporting, and inventory management. Strong API for integrations. | Subscription-based, tiered pricing depending on features and number of users. |

| QuickBooks Self-Employed | Expense tracking (mileage tracking included), income tracking, tax preparation assistance (including 1099 preparation), simple invoicing. Designed specifically for self-employed individuals. | Subscription-based, with different plans available depending on features required. |

| Zoho Invoice | Invoice creation and management, expense tracking, payment processing integrations, time tracking, recurring invoicing, client management. Offers a free plan with limitations. | Freemium model: free plan with limitations, paid plans with increased features and user limits. |

| Wave Accounting | Invoice creation, expense tracking, receipt scanning, basic accounting reports. Offers a free plan with unlimited invoicing and expense tracking. | Freemium model: free plan with limited features, paid plans for advanced features such as payroll. |

Choosing the Right App

Selecting the ideal finance app for managing freelance income requires careful consideration of several key factors. The right app will streamline your financial processes, saving you time and reducing stress, while a poorly chosen one can create more headaches than it solves. This section will guide you through the process of evaluating different apps to find the perfect fit for your individual needs.Finding the perfect app involves a thoughtful evaluation process, balancing functionality with personal preferences.

This isn’t a one-size-fits-all situation; the best app for a graphic designer might be entirely different from the best app for a software developer. Consider your unique workflow and financial habits to make an informed decision.

Factors to Consider When Selecting a Finance App

Several crucial factors influence the suitability of a finance app for freelancers. These include ease of use, integration capabilities, cost, and security features. A user-friendly interface is essential for efficient management, while seamless integration with other tools improves workflow. Cost considerations encompass both subscription fees and potential transaction charges. Robust security protocols are paramount to protect sensitive financial data.

A Step-by-Step Guide for App Evaluation

- Identify Your Needs: Begin by clearly defining your requirements. Do you need basic expense tracking, invoicing capabilities, tax preparation assistance, or more advanced features like project management integration? List your priorities to narrow down your options.

- Research and Compare Apps: Once you’ve identified your needs, research different apps that cater to those needs. Compare their features, user reviews, and pricing models. Websites like Capterra or G2 offer comprehensive reviews and comparisons of various finance apps.

- Test the Apps (Free Trials): Most finance apps offer free trials or freemium versions. Take advantage of these to test the app’s functionality and user interface. This hands-on experience will give you a much better understanding of whether the app suits your workflow.

- Check for Integrations: Assess whether the app integrates with other tools you regularly use, such as accounting software, payment gateways (e.g., PayPal, Stripe), or project management platforms. Seamless integration streamlines your workflow and minimizes data entry.

- Evaluate Security Features: Examine the app’s security measures. Look for features like two-factor authentication, data encryption, and regular security updates. Protecting your financial data is paramount.

- Consider Customer Support: A responsive and helpful customer support team is invaluable. Check the app’s customer support channels (email, phone, live chat) and look for reviews mentioning the quality of support provided.

Avoiding Common Pitfalls

Choosing the wrong app can lead to wasted time and frustration. Avoid common pitfalls by thoroughly researching and testing apps before committing. Don’t be swayed solely by marketing hype; prioritize functionality and reliability over flashy features. Failing to check security features can expose your financial data to risks, so prioritize apps with robust security measures. Finally, neglecting to consider integration with existing tools can create workflow inefficiencies.

A well-integrated system will save you significant time and effort in the long run.

Advanced App Features & Integrations

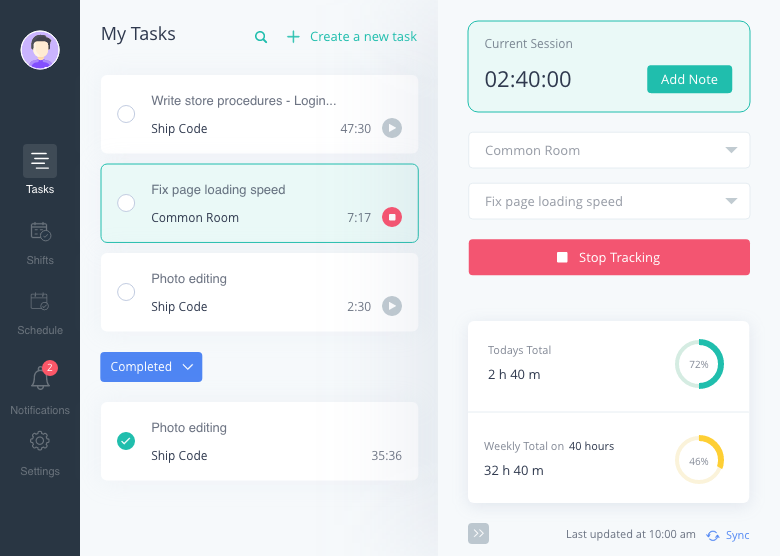

Source: apploye.com

Many top-rated finance apps for freelancers offer advanced features beyond basic income and expense tracking. These features significantly streamline financial management, improving accuracy and saving valuable time. Integrating these apps with other productivity tools further enhances efficiency and provides a holistic view of your freelance business.Leveraging advanced features and strategic integrations is key to maximizing the benefits of these apps.

Managing freelance income effectively requires utilizing top-rated finance apps designed for tracking expenses and income. These apps often integrate with other productivity tools, and some even offer educational resources; for further learning on financial literacy, you might find valuable courses on Education Apps. Returning to freelance finance, remember to choose an app that suits your specific needs and reporting preferences for optimal income management.

Proper utilization can lead to significant improvements in financial organization and ultimately, profitability.

Automated Expense Categorization and Recurring Invoice Generation

Several apps utilize machine learning to automatically categorize expenses based on transaction descriptions. For example, FreshBooks automatically categorizes expenses based on merchant names and transaction details. You can review and adjust these categorizations, ensuring accuracy. Similarly, Zoho Invoice offers automated recurring invoice generation, allowing you to schedule invoices for regular clients. This eliminates manual data entry and minimizes the risk of missed payments.

This feature is particularly helpful for freelancers with recurring projects or subscription-based services. Imagine setting up a monthly invoice for a client who pays you for ongoing website maintenance; the app handles the creation and scheduling, saving you time and effort.

Bank Account Linking and Real-Time Data Updates

Linking your bank account to finance apps provides real-time data updates, offering a dynamic view of your financial status. This feature, available in apps like QuickBooks Self-Employed and Xero, eliminates the need for manual data entry, reducing errors and saving time. QuickBooks Self-Employed, for instance, automatically imports transactions, categorizes them, and helps track mileage for tax deductions. Xero offers similar functionalities, automatically importing transactions and categorizing them based on pre-defined rules.

Managing freelance income effectively requires utilizing top-rated finance apps; these tools offer features like expense tracking and invoicing. However, remember that effective client acquisition often relies on a strong social media presence, so consider supplementing your financial planning with a well-crafted strategy across platforms like those listed on Social Media Apps. Ultimately, the best finance apps for freelancers will integrate seamlessly with your overall business development, including your social media marketing efforts.

This real-time synchronization ensures your financial data is always up-to-date, enabling informed decision-making.

Managing freelance income effectively requires utilizing top-rated finance apps designed for tracking expenses and income. These apps often integrate seamlessly with other productivity tools, and to maximize your workflow, consider exploring additional options available on this helpful resource for Productivity Apps. Returning to finance apps, remember to choose one that suits your specific needs and preferences for streamlined freelance financial management.

Integration with Productivity Tools

Integrating finance apps with other productivity tools significantly enhances workflow efficiency. Connecting your finance app with project management software, such as Asana or Trello, allows for seamless tracking of project expenses and profitability. For instance, you could link a specific project in Asana to an invoice in FreshBooks, providing a clear overview of project costs and revenue. Similarly, integrating your finance app with a calendar app (like Google Calendar) can automate reminders for invoice deadlines and tax payments.

Potential Integrations for Freelance Professionals

A well-integrated system can significantly boost productivity. Here’s a list of beneficial integrations for freelancers:

- Project Management Software: Asana, Trello, Monday.com – for linking project costs to invoices and tracking profitability.

- Calendar Apps: Google Calendar, Outlook Calendar – for scheduling invoice reminders and tax deadlines.

- Time Tracking Apps: Toggl Track, Clockify – for accurate time tracking and linking work hours to invoices.

- CRM Software: HubSpot, Salesforce – for managing client relationships and tracking payments.

- Payroll Software: Gusto, ADP – for managing payments to contractors or employees if applicable.

These integrations create a centralized system, reducing the need to switch between multiple applications and minimizing the risk of data inconsistencies. The streamlined workflow leads to improved efficiency and better financial management.

Security and Privacy Considerations

Managing your freelance finances through apps requires a high degree of trust. Your sensitive financial data—income, expenses, tax information—is entrusted to these platforms, making robust security and privacy paramount. Choosing apps with strong security measures is crucial to protect yourself from potential financial risks.Protecting your financial information within these apps requires a proactive approach. Many apps offer a variety of security features, but it’s essential to understand how to utilize them effectively and to maintain good security practices beyond the app itself.

Neglecting these measures can leave you vulnerable to identity theft, fraud, and other financial harms.

Data Encryption and Storage

Data encryption is a critical security feature. Reputable finance apps employ encryption methods, such as AES-256, to protect your data both in transit (when it’s being sent between your device and the app’s servers) and at rest (when it’s stored on the app’s servers). Look for apps that explicitly state their encryption methods and where your data is stored.

For example, an app might state that it uses AES-256 encryption and that data is stored on servers located within a specific, secure geographic region. Apps that lack transparency about their encryption practices should be viewed with caution.

Authentication and Access Controls

Strong authentication methods are essential. Multi-factor authentication (MFA), which requires multiple forms of verification (e.g., password, one-time code from your phone), is a significant improvement over simple password-based logins. Biometric authentication, such as fingerprint or facial recognition, can also add an extra layer of security. Furthermore, robust access controls, such as the ability to set up complex passwords and require password changes regularly, further enhance security.

The best apps will offer a combination of these features.

Security Audits and Compliance

Independent security audits provide valuable assurance. Reputable finance apps undergo regular security audits to identify and address potential vulnerabilities. Compliance with industry security standards, such as SOC 2 (System and Organization Controls 2), demonstrates a commitment to data security and privacy. Look for apps that openly share information about their security audits and compliance certifications. This transparency signals a higher level of commitment to security than apps that do not publicly disclose such information.

Data Privacy Policies and Practices

Review the app’s privacy policy carefully. A comprehensive privacy policy should clearly Artikel how your data is collected, used, shared, and protected. Pay close attention to sections addressing data retention policies and data sharing with third parties. Apps that are transparent about their data handling practices and offer users control over their data are generally more trustworthy.

Managing freelance income effectively requires utilizing top-rated finance apps designed for tracking expenses and income. These apps often integrate with other platforms, including those for selling goods or services online, such as the various options available in the E-commerce Apps market. Therefore, choosing the right finance app can significantly streamline your financial operations and provide valuable insights into your freelance business performance.

For example, a transparent privacy policy might explicitly state that the app does not sell user data to third-party advertisers.

Comparison of Security Measures Across Apps

Different apps offer varying levels of security. While a detailed comparison across all available apps is beyond the scope of this discussion, it’s crucial to note that some apps may prioritize security more heavily than others. Before selecting an app, research individual apps’ security features and compare them based on factors like encryption methods, authentication options, security audits, and data privacy policies.

User reviews and independent security assessments can also provide valuable insights. For instance, some apps may receive higher ratings for security from independent review sites specializing in financial technology.

Managing freelance income effectively requires utilizing top-rated finance apps; these tools offer features like expense tracking and invoicing. However, remember to factor in all income streams, even seemingly small ones, such as those from using apps like Food Delivery Apps for supplemental earnings. Returning to the core topic, proper use of finance apps is crucial for maintaining a clear financial picture and optimizing your freelance business.

Illustrative Examples of App Usage

Understanding how finance apps function in real-world freelance scenarios is crucial for effective income management. The following examples demonstrate how different app features can streamline various aspects of freelance work, from tracking income to preparing tax documents.

Tracking Project Income with FreshBooks

Imagine Sarah, a freelance graphic designer, using FreshBooks to manage her income. She creates an invoice for each project within the app, detailing the client, services rendered, and payment terms. FreshBooks automatically tracks payments received, providing Sarah with a clear overview of her income per project and overall earnings. The app’s reporting features then allow her to generate customized reports for her accountant, detailing income by client, project, or date range.

This detailed record-keeping ensures accurate tax filings and facilitates informed business decisions based on actual revenue streams. The automated invoice creation and payment tracking features save Sarah significant time compared to manual record-keeping.

Managing Expenses with QuickBooks Self-Employed

Let’s consider Mark, a freelance web developer, using QuickBooks Self-Employed to manage his expenses. He connects his business bank account and credit cards to the app, allowing QuickBooks Self-Employed to automatically categorize and track his transactions. The app intelligently identifies business expenses, simplifying the process of separating personal and business spending. Mark can also manually add expenses not automatically categorized, such as mileage reimbursements.

QuickBooks Self-Employed provides detailed expense reports, which are vital for tax preparation and identifying areas where Mark might reduce costs. The automated categorization and reporting features save Mark considerable time and effort compared to using spreadsheets or manual tracking methods. He can easily see a clear picture of his profit margins by comparing his income against expenses.

Preparing Tax Documents with Xero

Consider Anna, a freelance writer, using Xero to prepare her tax documents. She meticulously tracks her income and expenses within the app throughout the year. Xero’s features enable her to categorize transactions according to tax-relevant codes. At the end of the tax year, Xero automatically generates various reports including profit and loss statements, balance sheets, and expense summaries.

These reports are formatted to simplify the tax filing process, providing Anna with the necessary data to accurately complete her tax return. The app’s ability to categorize transactions and generate compliant reports greatly reduces the time and effort involved in tax preparation, minimizing the risk of errors and ensuring compliance. This streamlined process allows Anna to focus on her writing instead of tedious accounting tasks.

Wrap-Up

Mastering freelance finances is paramount for sustainable success. By leveraging the power of top-rated finance apps, freelancers can transform their financial management from a daunting task into a streamlined and efficient process. From simple expense tracking to sophisticated tax preparation assistance, the right app can significantly improve financial organization, cash flow, and overall business health. Remember to carefully consider your individual needs and preferences when choosing an app, prioritizing features, security, and ease of use to optimize your financial workflow.

User Queries

What are the best apps for freelancers who travel frequently?

Apps with strong mobile interfaces and offline capabilities are ideal for traveling freelancers. Look for features like easy expense entry on the go and reliable syncing across devices.

How do I choose an app that integrates with my existing accounting software?

Most finance apps offer integrations with popular accounting software. Check the app’s website or documentation for a list of compatible platforms. Prioritize apps with open APIs for wider integration possibilities.

Are there free finance apps suitable for freelancers?

Yes, several free apps offer core features like expense tracking and invoicing, though they may have limitations on advanced features or user support compared to paid options. Consider your needs and budget when deciding between free and paid apps.

What security measures should I look for in a finance app?

Look for apps that utilize robust encryption, two-factor authentication, and regular security updates. Read user reviews and check the app’s privacy policy to ensure your data is protected.