Affordable Finance Apps Offering Comprehensive Financial Planning

Affordable finance apps offering comprehensive financial planning are revolutionizing personal finance management. These apps, ranging from free basic tools to subscription services with advanced features, empower individuals to take control of their financial futures. This exploration delves into the features, benefits, and limitations of these applications, examining how they cater to diverse user needs and financial goals.

We will explore the definition of “affordable” and “comprehensive” in this context, comparing free and paid options, and analyzing the core functionalities crucial for effective financial planning. We’ll also examine the target user demographics, discuss the importance of user-friendly interfaces and robust security measures, and consider the future impact of emerging technologies on these essential tools.

Defining “Affordable” and “Comprehensive” in Financial Planning Apps

Choosing a financial planning app involves navigating a landscape of varying costs and feature sets. Understanding what constitutes “affordable” and “comprehensive” is crucial for making an informed decision that aligns with your individual needs and budget. This section clarifies these terms and explores the options available.

Many affordable finance apps provide excellent tools for comprehensive financial planning, helping users budget, track spending, and even invest. However, managing impulsive spending, like frequent orders from services such as Food Delivery Apps , can significantly impact your financial goals. Therefore, integrating mindful spending habits into your financial plan, alongside using these helpful apps, is key to achieving long-term financial success.

Affordability in Financial Planning Apps

The spectrum of affordability in financial planning apps ranges from completely free applications supported by advertising or in-app purchases, to subscription-based services with varying monthly or annual fees. Free apps often offer basic features, while paid apps usually provide more advanced tools and functionalities. Subscription models can also vary significantly; some offer tiered pricing with different feature sets at each level, allowing users to select a plan that best suits their needs and budget.

For instance, a basic plan might include budgeting and expense tracking, while a premium plan might add investment management, tax planning, and personalized financial advice. Ultimately, “affordable” is subjective and depends on individual financial circumstances and the perceived value of the app’s features.

Comprehensive Financial Planning Features

Comprehensive financial planning involves managing various aspects of your finances. Essential features for a comprehensive app include robust budgeting tools, detailed expense tracking, secure investment tracking capabilities, effective debt management tools, and clear financial goal-setting functionalities. Additional features like retirement planning tools, tax optimization features, and personalized financial advice can further enhance the comprehensiveness of the app. The ability to link to multiple bank accounts and credit cards for seamless data aggregation is also a key element of a truly comprehensive solution.

Comparison of Free vs. Paid Apps

Free financial planning apps often offer a limited set of features, usually focusing on basic budgeting and expense tracking. These apps may generate revenue through advertising or in-app purchases for premium features. In contrast, paid apps typically provide a more comprehensive suite of tools, including advanced analytics, investment tracking, debt management strategies, and personalized financial advice. The level of customer support also often differs, with paid apps typically offering more responsive and dedicated support channels.

While free apps can be a good starting point for basic financial management, users seeking more advanced features and personalized guidance may find paid apps to be more beneficial.

Comparison of Popular Financial Planning Apps

| App Name | Price | Budgeting Features | Investment Tracking | Debt Management Tools | Financial Goal Setting |

|---|---|---|---|---|---|

| Mint | Free (with ads) | Excellent | Basic | Basic | Basic |

| Personal Capital | Free (with premium options) | Good | Excellent | Good | Good |

| YNAB (You Need A Budget) | Subscription-based | Excellent | Limited | Good | Excellent |

| EveryDollar | Free (with premium options) | Excellent | Limited | Good | Good |

| PocketGuard | Free (with premium options) | Good | Limited | Good | Good |

Key Features of Affordable, Comprehensive Financial Planning Apps: Affordable Finance Apps Offering Comprehensive Financial Planning

Affordable, comprehensive financial planning apps are transforming how individuals manage their finances. By offering a suite of tools in an accessible format, these apps empower users to take control of their financial well-being, regardless of their technical expertise or financial background. This section details the core functionalities and features that define such applications.

Effective financial planning requires a multifaceted approach. A truly comprehensive app needs to cover key areas of personal finance, all while maintaining a user-friendly design and robust security protocols.

Core Functionalities for Effective Financial Planning

A successful financial planning app must provide a robust set of tools to address the key aspects of personal finance management. These core functionalities are essential for users to track their progress and make informed decisions.

- Budgeting: The app should allow users to easily track income and expenses, categorize transactions, and set realistic budget goals. Features like automated transaction categorization and visual representations of spending habits (e.g., pie charts) significantly enhance the budgeting experience.

- Saving: Users need tools to set savings goals, track progress towards those goals, and potentially explore different savings strategies (e.g., high-yield savings accounts, automated transfers). The app should provide clear visualizations of savings growth over time.

- Investing: While some apps may integrate with brokerage accounts, even basic features like investment tracking and educational resources on investing fundamentals can be incredibly valuable. This allows users to monitor their investment portfolio performance and make informed decisions.

- Debt Tracking: The ability to track various debts (credit cards, loans, etc.), visualize repayment progress, and explore different debt repayment strategies (e.g., snowball or avalanche method) is crucial for effective debt management. The app should provide clear visualizations of debt reduction over time.

User-Friendly Interfaces and Intuitive Navigation

Intuitive design is paramount for the success of any financial planning app, especially affordable ones targeting a broad user base. A complex or confusing interface can deter users, undermining the app’s purpose.

Simplicity and clarity are key. The app should feature a clean, uncluttered layout, with easily accessible menus and clear instructions. Data visualization through charts and graphs should be used effectively to present complex financial information in an easily digestible format. For example, a well-designed app might use color-coding to highlight areas of overspending or progress towards savings goals.

Security Measures for Protecting User Financial Data

Protecting user financial data is of utmost importance. Affordable apps should not compromise on security. Robust security measures are essential to build user trust and ensure the safety of sensitive information.

This includes employing industry-standard encryption protocols to protect data both in transit and at rest. Multi-factor authentication, password management tools, and regular security audits should be implemented. Transparency about data handling practices and adherence to relevant privacy regulations (e.g., GDPR, CCPA) are crucial for building user confidence.

Innovative Features Enhancing User Experience and Financial Literacy, Affordable finance apps offering comprehensive financial planning

Many affordable apps incorporate innovative features that go beyond basic financial management. These features enhance user experience and improve financial literacy.

Examples include personalized financial advice based on user data and goals (often employing algorithms and AI), gamification techniques to incentivize saving and budgeting, and integration with other financial services (e.g., bill pay). Educational resources, such as articles, videos, and interactive tutorials on personal finance topics, can significantly improve users’ financial literacy and empower them to make informed decisions.

Target User Demographics and App Suitability

Affordable, comprehensive financial planning apps cater to a broad spectrum of users, but their suitability varies depending on individual financial complexity and tech-savviness. While these apps offer valuable tools for many, understanding their limitations is crucial for effective user experience.The ideal users for these apps are individuals seeking basic to intermediate-level financial planning assistance, prioritizing ease of use and cost-effectiveness over highly specialized features.

Many affordable finance apps provide excellent tools for comprehensive financial planning, helping users budget, track spending, and even invest. However, managing impulsive spending, like frequent orders from services such as Food Delivery Apps , can significantly impact your financial goals. Therefore, integrating mindful spending habits into your financial plan, alongside using these helpful apps, is key to achieving long-term financial success.

These apps are less suitable for those with intricate financial portfolios requiring advanced tax strategies or complex investment management.

User Personas and Tailored Features

The following user personas illustrate how different demographics can benefit from these apps, highlighting their specific needs and the corresponding features that address them.

- Persona 1: The Student (Sarah, 20): Sarah is a college student juggling part-time work and studies. She needs help budgeting, tracking expenses, and saving for future goals like paying off student loans and building an emergency fund.

- Tailored Features: Simple budgeting tools, expense tracking, savings goal setting, debt management tools (loan repayment calculators), basic investment education resources.

- Persona 2: The Young Professional (Mark, 28): Mark is a recent graduate with a stable job and is starting to think about long-term financial planning, including saving for a down payment on a house and investing. He needs help with budgeting, investing, and retirement planning.

- Tailored Features: Advanced budgeting tools, investment tracking (with basic portfolio analysis), retirement planning calculators, mortgage calculators, tax estimation tools (basic).

- Persona 3: The Family (John & Jane, 35 & 37): John and Jane are a married couple with two young children. They need help managing their household budget, planning for their children’s education, and saving for retirement.

- Tailored Features: Family budgeting tools, college savings calculators, retirement planning tools (with options for multiple income streams), life insurance needs assessment tools.

Limitations of Affordable Apps for Complex Financial Situations

While affordable apps provide valuable tools for many, they have inherent limitations for users with complex financial situations. These limitations stem primarily from the simplified nature of their algorithms and the lack of personalized financial advice.For instance, users with significant investment portfolios, multiple income streams, or complex tax situations may find the built-in features insufficient. The automated advice provided may not account for nuanced circumstances, such as inherited assets, trusts, or significant charitable giving.

Furthermore, these apps generally lack the personalized support offered by financial advisors who can provide tailored strategies based on individual circumstances. In such cases, professional financial advice is recommended. The simplified nature of the algorithms in affordable apps also limits their ability to provide sophisticated investment strategies or comprehensive tax planning.

Comparison of Popular Affordable Financial Planning Apps

Choosing the right financial planning app can significantly impact your financial journey. This comparison focuses on three popular, affordable options, highlighting their strengths and weaknesses across key features to help you make an informed decision. We will examine their budgeting tools, investment capabilities, debt management features, and reporting functionalities, illustrating how each app supports various financial goals.

Many individuals seek affordable finance apps offering comprehensive financial planning tools to manage their finances effectively. A great place to start your search for suitable options is by exploring the wide range of applications available at Finance Apps , which provides a helpful overview. Finding the right app can significantly improve your budgeting, saving, and investment strategies, leading to better financial health.

Budgeting Tool Comparison

Effective budgeting is crucial for achieving financial goals. The apps reviewed offer varying levels of sophistication in their budgeting tools. App A provides a straightforward, category-based budgeting system, ideal for beginners. App B incorporates more advanced features like zero-based budgeting and automated transaction categorization, appealing to users seeking more control. App C offers a hybrid approach, blending simplicity with customizable options to cater to a wider range of user needs.

Each app integrates with bank accounts for automatic transaction tracking, though the level of automation and accuracy may vary.

Managing personal finances effectively is simplified with the rise of affordable finance apps offering comprehensive financial planning tools. These apps often integrate with other platforms, such as E-commerce Apps , to provide a holistic view of spending habits. This integration allows users to track purchases and better understand their financial behaviors, ultimately leading to improved budgeting and saving strategies within the app’s planning features.

Investment Feature Comparison

Investment features vary considerably. App A offers basic investment tracking, allowing users to manually input their investments and monitor performance. App B integrates with brokerage accounts, providing more comprehensive portfolio tracking and analysis. App C goes a step further, offering robo-advisor capabilities with automated investment strategies tailored to risk tolerance and financial goals. While App A is suitable for those with simple investment portfolios, Apps B and C cater to users with more complex investment needs.

Debt Management Capability Comparison

Managing debt effectively is a key aspect of financial planning. App A provides basic debt tracking, allowing users to monitor balances and payments. App B offers more advanced debt management tools, such as debt snowball or avalanche calculators, helping users strategize repayment plans. App C incorporates features like debt consolidation recommendations and integrates with loan providers for streamlined payment management.

App B and C are particularly beneficial for users struggling with multiple debts.

Reporting Functionality Comparison

Comprehensive reporting is essential for understanding financial progress. App A generates basic reports on income, expenses, and net worth. App B provides more detailed reports, including customizable charts and graphs, allowing users to visualize their financial health over time. App C offers the most robust reporting capabilities, with features like personalized financial summaries and goal progress trackers. The level of detail and customization available in each app’s reporting section directly correlates with the complexity of its features.

Many affordable finance apps now provide comprehensive financial planning tools, helping users budget, save, and invest more effectively. Understanding these tools is key, and resources like those found on websites dedicated to Education Apps can help users learn how to best utilize such apps. Ultimately, mastering these apps empowers individuals to take control of their financial futures through accessible and user-friendly interfaces.

User Interface Comparison

A visual comparison reveals distinct differences in user interface design. App A features a clean, minimalist design, prioritizing ease of navigation for beginners. Its simplicity, however, may lack the visual appeal and advanced customization options found in other apps. App B adopts a more modern, visually engaging design, incorporating interactive charts and graphs. While visually appealing, the interface might feel overwhelming to some users.

App C strikes a balance, combining a user-friendly layout with sophisticated visual elements, offering a visually rich yet intuitive experience. A visual representation would show App A as simple and text-heavy, App B as more graphically complex, and App C as a balanced blend of both. App A’s strength is its simplicity, App B’s is its visual richness, and App C’s is its balanced approach.

Future Trends in Affordable Financial Planning Apps

The landscape of personal finance management is rapidly evolving, driven by technological advancements and shifting consumer expectations. Affordable financial planning apps are at the forefront of this change, constantly adapting to offer more comprehensive features and enhanced user experiences. The future of these apps hinges on leveraging emerging technologies, embracing open banking principles, and anticipating evolving user needs.The integration of sophisticated technologies and open data sharing promises to revolutionize the affordability and scope of financial planning tools.

Impact of Emerging Technologies

Artificial intelligence (AI) and machine learning (ML) are poised to significantly impact the affordability and comprehensiveness of financial planning apps. AI-powered tools can automate tasks like budgeting, expense tracking, and investment analysis, reducing the need for expensive human advisors. ML algorithms can personalize financial advice based on individual user data and market trends, offering tailored recommendations for saving, investing, and debt management.

For example, an app could use ML to predict future spending patterns based on past behavior, helping users proactively adjust their budgets and avoid overspending. This level of personalization would enhance the app’s value proposition without necessarily increasing its cost to the user. Furthermore, AI can automate customer support functions, further reducing operational costs for app developers and potentially leading to lower subscription fees or free versions with limited features.

The Role of Open Banking and Data Aggregation

Open banking initiatives, which allow users to securely share their financial data with third-party apps, are transforming the possibilities for financial planning. Data aggregation tools can consolidate information from various accounts – bank accounts, credit cards, investment portfolios – into a single, unified view. This comprehensive overview empowers users with a clearer picture of their overall financial health and allows apps to provide more accurate and personalized financial advice.

For instance, an app could analyze aggregated data to identify areas for improvement in budgeting or investment strategies, providing actionable insights that would be impossible without access to this consolidated data. The increased data availability also facilitates the development of more sophisticated algorithms for financial forecasting and risk assessment.

Future Development of Features and Functionalities

We can expect to see several key developments in the features and functionalities of affordable financial planning apps in the coming years. Gamification techniques, such as points, badges, and leaderboards, are likely to become more prevalent, encouraging user engagement and promoting positive financial habits. Increased integration with other financial services, such as insurance and tax preparation platforms, will provide a more holistic financial planning experience.

Enhanced security features, including biometric authentication and advanced fraud detection, will be crucial for building user trust and protecting sensitive financial data. Furthermore, the rise of personalized financial coaching features within apps, offering tailored guidance from certified financial professionals, will likely cater to users seeking more comprehensive support. Robinhood’s integration of educational resources and fractional share trading is a good example of this trend, although not all features are entirely free.

Many affordable finance apps provide excellent tools for comprehensive financial planning, helping users budget, track spending, and even invest. However, managing impulsive spending, like frequent orders from services such as Food Delivery Apps , can significantly impact your financial goals. Therefore, integrating mindful spending habits into your financial plan, alongside using these helpful apps, is key to achieving long-term financial success.

Challenges and Opportunities for Developers

The development of affordable financial planning apps presents both challenges and opportunities:

- Challenge: Data Security and Privacy: Protecting user data from breaches and ensuring compliance with privacy regulations is paramount. Robust security measures are essential to maintain user trust.

- Opportunity: Leveraging AI and ML: The potential of AI and ML to personalize financial advice and automate tasks is significant, but requires investment in skilled personnel and advanced algorithms.

- Challenge: Regulatory Compliance: Navigating the complex regulatory landscape surrounding financial services is a major hurdle for developers.

- Opportunity: Expanding to Emerging Markets: Affordable financial planning apps have the potential to reach underserved populations in developing countries, promoting financial inclusion.

- Challenge: Maintaining Affordability: Balancing the need for advanced features with the requirement for affordability requires careful cost management and innovative monetization strategies.

- Opportunity: Partnerships and Integrations: Collaborating with other financial institutions and technology providers can expand the reach and capabilities of financial planning apps.

Final Thoughts

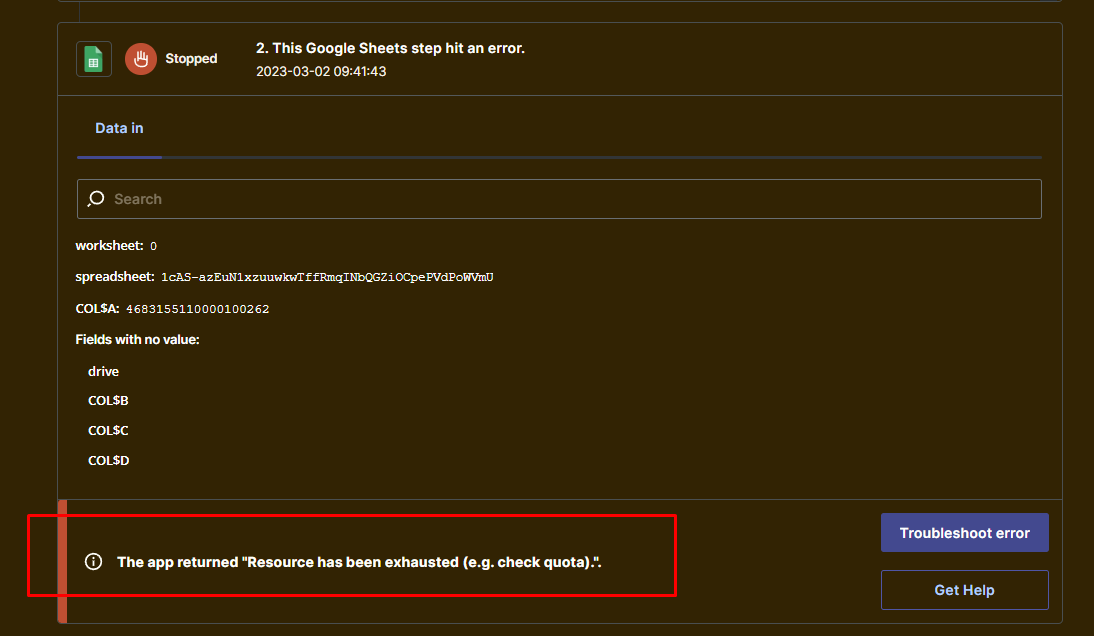

Source: insided.com

Ultimately, the accessibility and comprehensive features offered by affordable financial planning apps represent a significant step toward empowering individuals to achieve their financial goals. While limitations exist, particularly for users with complex financial situations, the ongoing innovation and integration of emerging technologies promise to further enhance the capabilities and user experience of these valuable tools. Choosing the right app depends heavily on individual needs and financial literacy goals, but the potential for improved financial management is undeniable.

User Queries

What data security measures should I look for in a financial planning app?

Look for apps that utilize robust encryption, two-factor authentication, and comply with relevant data privacy regulations. Read reviews and privacy policies carefully before entrusting your financial data.

Are these apps suitable for all levels of financial expertise?

While many apps are designed with user-friendliness in mind, some advanced features may require a basic understanding of financial concepts. Beginners may benefit from starting with simpler apps and gradually exploring more complex functionalities.

Can I link my bank accounts and other financial accounts to these apps?

Many apps offer account linking capabilities, but it’s crucial to verify the app’s security measures and review its privacy policy before connecting your accounts. Always be cautious about granting access to your financial information.

What if I have complex financial needs, such as multiple investments or significant debt?

While affordable apps can be helpful, individuals with highly complex financial situations may benefit from consulting with a financial advisor for personalized guidance. Some apps may lack the sophistication to handle intricate financial scenarios.

How can I ensure the accuracy of the financial data presented in these apps?

Regularly verify the information presented by the app against your own financial records. Report any discrepancies to the app’s support team. Remember that these apps are tools; they are not substitutes for diligent personal financial management.