Best Budgeting Apps with Debt Reduction Planning Tools

Best budgeting apps with debt reduction planning tools offer a powerful combination for tackling debt. These apps go beyond simple expense tracking, providing sophisticated tools and strategies to help users visualize their debt, create personalized repayment plans, and monitor progress. From debt snowball and avalanche methods to detailed amortization calculators, these apps empower individuals to take control of their finances and achieve financial freedom.

This exploration delves into the key features, selection criteria, and practical applications of these invaluable tools.

Understanding the various budgeting methods supported, such as the 50/30/20 rule or zero-based budgeting, is crucial. Different apps cater to different needs and preferences, offering a range of features from basic expense tracking to advanced financial planning capabilities. Factors like user interface, security, and integration with other financial accounts should also be carefully considered when choosing an app.

Ultimately, the best app is the one that aligns with your individual financial goals and usage habits.

Introduction to Budgeting Apps and Debt Reduction

Personal finance apps have become invaluable tools in the modern era, offering convenient and efficient ways to manage finances, particularly when tackling debt. These apps provide a centralized platform to track income, expenses, and debt payments, offering insights and tools to help users gain control of their financial situation and achieve their debt reduction goals.Using budgeting apps for debt reduction offers numerous benefits.

They provide a clear picture of your spending habits, allowing you to identify areas where you can cut back. Automated features, such as scheduled bill payments and savings transfers, ensure consistent progress towards your debt goals. Many apps offer debt reduction strategies and tools, such as debt snowball or avalanche methods, to optimize repayment plans. The visual representation of progress—through graphs and charts—can provide significant motivation and a sense of accomplishment.

Budgeting Methods Supported by Apps

Many budgeting apps support various budgeting methods to cater to different financial styles and preferences. Popular methods include the 50/30/20 rule, where 50% of income is allocated to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting, another common approach, involves allocating every dollar of income to a specific expense category, ensuring that all spending is accounted for and preventing overspending.

Some apps also allow for customized budgeting methods, enabling users to create a system tailored to their unique financial circumstances.

Comparison of Budgeting App Categories

| Feature | Free Apps | Paid Apps | Basic Apps | Advanced Apps |

|---|---|---|---|---|

| Cost | Free (often with ads or limited features) | Subscription fee (monthly or annual) | Basic tracking and budgeting features | Advanced features like debt reduction planning, investment tracking, financial forecasting |

| Features | Expense tracking, basic budgeting tools | Advanced features, personalized financial advice, priority support | Simple interface, limited customization options | Sophisticated tools, customizable dashboards, multiple account linking |

| Data Security | Variable levels of security | Generally higher security measures | May lack robust encryption | Strong encryption and data protection features |

| Customer Support | Limited or community-based support | Dedicated customer support channels | Basic FAQs and email support | Comprehensive support, including phone, email, and chat |

Key Features of Debt Reduction Planning Tools within Apps

Budgeting apps increasingly incorporate sophisticated debt reduction planning tools, offering users a more proactive approach to managing their finances. These tools move beyond simple budgeting features, providing users with strategies, visualizations, and progress tracking to effectively tackle their debt. The core functionality revolves around helping users understand their debt, choose a repayment strategy, and monitor their progress towards a debt-free future.Effective debt reduction planning requires understanding different strategies and their implications.

Many apps offer tools that visualize debt and track progress, offering a clear picture of the user’s financial situation and the impact of their repayment efforts. This visualization, combined with the strategic planning tools, empowers users to make informed decisions and stay motivated throughout the debt repayment journey.

Debt Reduction Strategies: Snowball vs. Avalanche

Two primary debt reduction strategies commonly implemented in budgeting apps are the debt snowball and debt avalanche methods. The debt snowball method focuses on paying off the smallest debts first, regardless of interest rate, to build momentum and motivation. The debt avalanche method, conversely, prioritizes paying off debts with the highest interest rates first, minimizing the total interest paid over time.

Both methods offer unique advantages and disadvantages, and the optimal choice depends on individual circumstances and psychological preferences.

- Debt Snowball Method: This method prioritizes psychological wins by tackling the smallest debts first. The quick wins can boost motivation and encourage consistent repayment efforts. However, it may result in paying more interest overall compared to the avalanche method.

- Debt Avalanche Method: This method prioritizes minimizing total interest paid by focusing on high-interest debts first. While it’s mathematically more efficient, the slower initial progress might lead to demotivation if not carefully managed.

Amortization Calculators and Debt Visualization

Amortization calculators are a crucial feature of many debt reduction tools. These calculators project the repayment schedule for a loan, showing the principal and interest paid each month, as well as the total interest paid over the life of the loan. This allows users to understand the true cost of their debt and the impact of different repayment strategies.

Many apps also offer visual representations of debt, such as charts and graphs, providing a clear and concise overview of the user’s debt burden and progress towards repayment. These visual aids can significantly improve understanding and engagement with the debt reduction process. For example, a pie chart might show the proportion of total debt allocated to each creditor, while a line graph might track the decrease in total debt over time.

Comparison of Debt Reduction Tools Across Popular Apps

Different budgeting apps offer varying levels of sophistication in their debt reduction tools. Some apps may simply provide a debt tracker, while others offer more comprehensive features such as integrated amortization calculators, multiple debt reduction strategy options (snowball, avalanche, and potentially others), and personalized recommendations based on the user’s financial data. For example, one app might excel in its visualization tools, offering interactive charts and graphs, while another might stand out with its robust debt simulation capabilities, allowing users to experiment with different repayment scenarios and their financial impact.

The specific features and user experience can vary significantly, so it’s essential to compare different apps before choosing one that best suits individual needs.

Advantages and Disadvantages of Debt Reduction Strategies

Understanding the advantages and disadvantages of each strategy is crucial for informed decision-making.

- Debt Snowball:

- Advantages: Motivational, provides quick wins, builds momentum.

- Disadvantages: May result in paying more total interest, slower overall debt reduction.

- Debt Avalanche:

- Advantages: Minimizes total interest paid, faster overall debt reduction.

- Disadvantages: Can be demotivating initially, requires discipline and patience.

App Selection Criteria and User Considerations

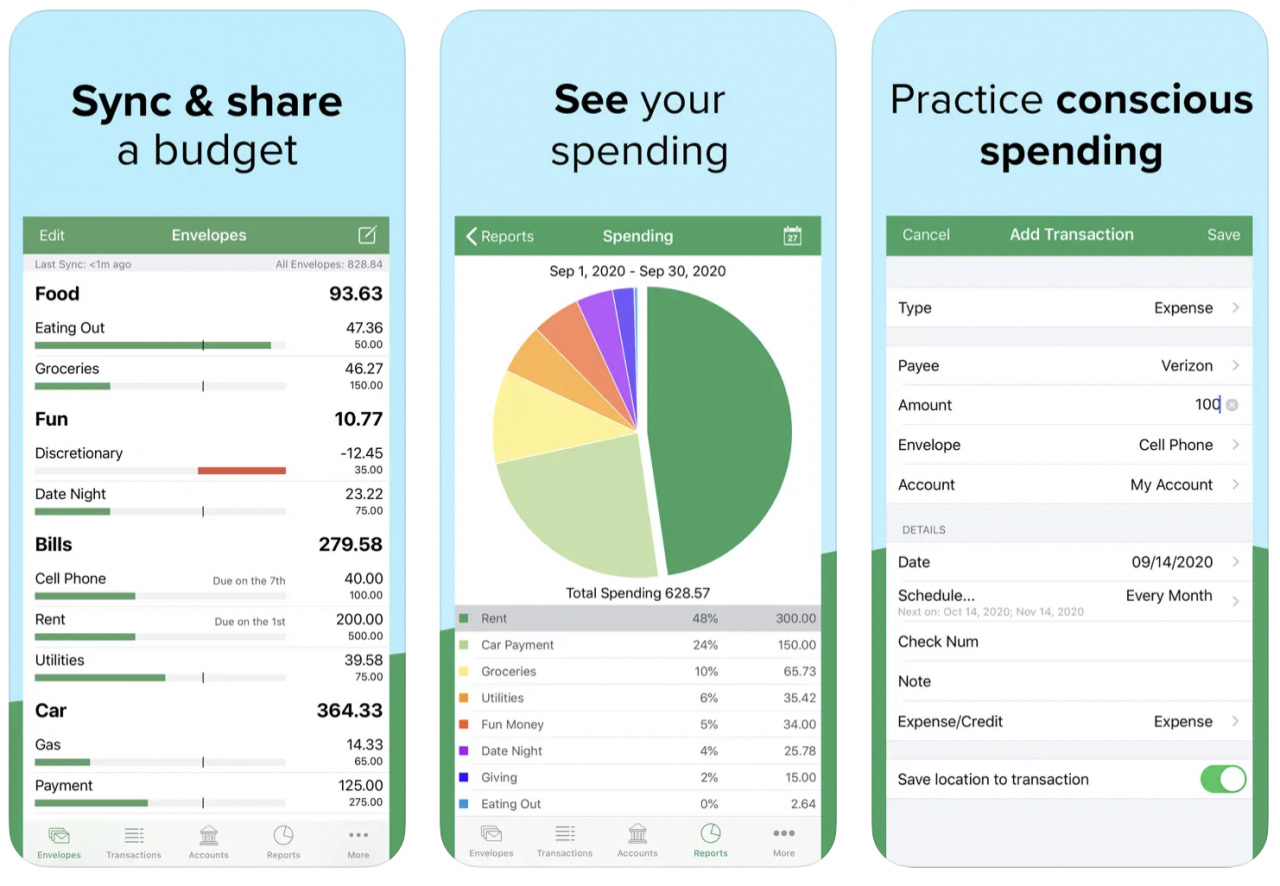

Source: techcrunch.com

Choosing the right budgeting app with debt reduction features is crucial for successfully managing your finances. A poorly chosen app can lead to frustration and hinder your progress, while a well-suited app can significantly simplify the process and empower you to achieve your financial goals. Careful consideration of several key factors will ensure you select an app that aligns with your needs and preferences.

Several factors influence the effectiveness and usability of a debt reduction app. Beyond the core functionality of budgeting and debt tracking, considerations such as user interface, security, and integration capabilities are equally important for a positive user experience and successful debt management.

App Selection Checklist

Before committing to a budgeting app, it’s beneficial to create a checklist of essential features and considerations. This will help you objectively compare different options and choose the one that best fits your specific needs and preferences.

- User Interface (UI) and User Experience (UX): Is the app intuitive and easy to navigate? Does it have a clean, uncluttered design? Are the features clearly labeled and accessible?

- Security Features: Does the app utilize robust security measures to protect your financial data? Does it employ encryption and multi-factor authentication? What is its privacy policy and how does it handle data sharing?

- Platform Compatibility: Is the app available on the platforms you use (e.g., iOS, Android, web)? Does it offer a consistent experience across devices?

- Integration with Other Financial Tools: Does the app integrate with your bank accounts, credit cards, and other financial accounts? This automation can save significant time and effort.

- Debt Reduction Planning Tools: Does the app offer features such as debt snowball or avalanche methods, debt payoff calculators, and personalized repayment plans? Are these tools easy to use and understand?

- Customer Support: What kind of customer support does the app offer? Is it readily available and responsive to user inquiries?

- Reporting and Analytics: Does the app provide clear and comprehensive reports on your spending, income, and debt progress? Are these reports customizable and exportable?

User-Friendliness and Ease of Navigation

A user-friendly interface is paramount for the success of any budgeting app, particularly one focused on debt reduction. A complex or confusing app can discourage users, leading to inconsistent usage and ultimately hindering their progress towards becoming debt-free. Intuitive navigation, clear visual representations of financial data, and simple, straightforward features are essential for promoting consistent engagement and motivation.

Potential Risks Associated with Budgeting Apps

While budgeting apps offer numerous benefits, it’s crucial to be aware of potential risks, primarily related to data privacy and security. Choosing a reputable app with a strong privacy policy and robust security measures is crucial to mitigate these risks.

- Data Breaches: Any app storing sensitive financial data is vulnerable to data breaches. Look for apps that employ strong encryption and security protocols.

- Data Privacy: Understand how the app collects, uses, and shares your data. Review the privacy policy carefully to ensure it aligns with your comfort level.

- App Errors: Like any software, budgeting apps can experience errors or glitches. This can lead to inaccurate data or disruptions in service. Reliable customer support is crucial in such situations.

Pricing Models and Subscription Options

Budgeting apps employ various pricing models, ranging from free options with limited features to paid subscriptions offering more advanced functionalities. The choice depends on your budget and the features you require.

| App Name | Free Version | Paid Version (Price/Month) | Key Features in Paid Version |

|---|---|---|---|

| Mint | Yes | N/A | N/A |

| YNAB (You Need A Budget) | Trial Period | $14.99 | Advanced budgeting tools, debt tracking, goal setting |

| Personal Capital | Yes | N/A | N/A |

| EveryDollar | Yes | $12.99 | Detailed budgeting features, debt payoff planning |

Illustrative Examples of App Usage for Debt Reduction

Budgeting apps, coupled with robust debt reduction planning tools, offer a powerful combination for tackling outstanding debts. This section provides practical examples demonstrating how users can leverage these apps to create and monitor effective debt repayment strategies. We will walk through a step-by-step example, showcasing how to build a plan, track spending, identify savings opportunities, and monitor progress.

Creating a Realistic Debt Reduction Plan

Let’s imagine Sarah, who has $10,000 in credit card debt and a $5,000 personal loan. Using a budgeting app like YNAB (You Need A Budget) or Mint, Sarah first inputs all her income sources (salary, side hustle income, etc.). Next, she meticulously lists all her expenses, categorizing them (housing, transportation, food, entertainment, etc.). The app then calculates her remaining funds after accounting for essential expenses.

Sarah allocates a portion of this remaining money to debt repayment, prioritizing higher-interest debts (the credit card in this case) using the avalanche or snowball method. The app allows her to adjust these allocations as needed, creating a dynamic and adaptable plan. For example, she might allocate $500 monthly to the credit card and $200 to the personal loan.

The app will then project the time it will take to pay off each debt based on her repayment plan.

Tracking Spending and Identifying Savings Opportunities

Once Sarah has established her budget, the app’s tracking features become crucial. By linking her bank accounts and credit cards, the app automatically categorizes her transactions. She can then easily visualize where her money is going. Suppose the app reveals she’s spending significantly more on dining out than budgeted. The app might suggest setting a lower spending limit for restaurants or creating a savings goal to offset the overspending.

Similarly, the app can highlight areas where she’s consistently underspending, allowing her to reallocate those funds towards her debt repayment. This data-driven approach allows for continuous improvement and refinement of her financial strategy.

Monitoring Debt Repayment Progress with App Reporting Features

Many budgeting apps provide comprehensive reports detailing debt repayment progress. These reports often include charts and graphs visualizing the reduction of debt balances over time. In Sarah’s case, the app might show a bar graph representing the initial debt amounts for both the credit card and personal loan. As she makes payments, the bars shorten, providing a visual representation of her progress.

The app could also provide a projected payoff date for each debt, constantly updating based on her actual spending and repayment activity. This visual feedback is highly motivating, enabling Sarah to stay on track and celebrate her achievements along the way.

Visual Representation of Debt Reduction Progress

Let’s consider a hypothetical visual representation within a budgeting app. The user interface might feature a circular progress bar for each debt. The circle is initially full, representing the total debt amount. As payments are made, the circle gradually fills with a color indicating progress. A numerical indicator displays the remaining balance and percentage paid off.

Below the progress bar, a timeline could visually show the projected payoff date, dynamically adjusting as payments are made or the repayment plan is modified. The app might also include a summary dashboard showing total debt reduction, total payments made, and remaining debt. This comprehensive visual overview empowers users to track their progress effectively and stay motivated throughout their debt repayment journey.

Advanced Features and Integrations

Many budgeting apps go beyond basic expense tracking and debt repayment calculators, offering sophisticated features and seamless integrations to enhance their users’ financial management capabilities. These advanced functionalities can significantly streamline the debt reduction process and provide valuable insights into one’s financial health. Understanding these features and their integrations is crucial for selecting the most suitable app for individual needs.The integration of budgeting apps with other financial services is a key factor influencing their effectiveness.

This integration allows for a holistic view of personal finances, simplifying data entry and providing a more accurate picture of financial standing. It also enables features that would be impossible without access to real-time account information.

Automated Savings and Financial Goal Setting, Best budgeting apps with debt reduction planning tools

Many advanced budgeting apps offer automated savings features, allowing users to schedule regular transfers to savings accounts. This automated approach removes the need for manual intervention, making saving more consistent. Furthermore, these apps often include tools for setting and tracking financial goals, whether it’s paying off debt, saving for a down payment, or building an emergency fund. Users can input their target amount and timeframe, and the app will calculate the required monthly savings.

Some apps even offer visual progress trackers to keep users motivated. For example, an app might show a progress bar filling up as the user approaches their savings goal, or display a chart illustrating the decreasing debt balance over time. This visual representation can be highly motivating for users.

Credit Score Monitoring

Several budgeting apps integrate with credit bureaus to provide users with access to their credit scores and reports. This feature allows users to monitor their credit health and identify any potential issues. Understanding one’s credit score is crucial for securing favorable interest rates on loans and credit cards, which directly impacts debt reduction strategies. The ability to track credit score changes over time within the budgeting app provides valuable insights into the effectiveness of debt repayment efforts.

For instance, a user might see their credit score improve as they consistently pay down their debts, reinforcing positive financial habits.

Bank and Credit Card Account Integration

The integration of budgeting apps with bank and credit card accounts is a game-changer. This integration automates the process of tracking transactions, eliminating the need for manual data entry. Real-time updates ensure that the budget is always accurate and up-to-date. This accuracy is critical for effective debt management, as it allows users to make informed decisions based on their actual spending habits and available funds.

For example, if a user has overspent in a particular category, the app can immediately flag this and provide insights into potential adjustments. Apps like Mint and Personal Capital are well-known for their robust integration capabilities.

Comparison of Integration Capabilities

Different budgeting apps vary in their integration capabilities. Some apps integrate with a wide range of financial institutions, while others may have more limited compatibility. The depth of integration also varies; some apps simply import transaction data, while others provide more sophisticated features, such as automated categorization and analysis. For instance, YNAB (You Need A Budget) focuses on a more manual, goal-oriented approach, while Mint provides a more automated experience with broader integration capabilities.

Choosing an app with seamless integration with all your financial accounts is crucial for maximizing its effectiveness.

Potential Future Developments in Debt Reduction Apps

The development of budgeting apps focused on debt reduction is an evolving field. Here are some potential future developments:

- AI-powered debt repayment strategies: Apps could utilize artificial intelligence to analyze individual financial situations and recommend optimized debt repayment strategies, considering factors such as interest rates and minimum payments.

- Personalized financial coaching: Integration with financial advisors or automated coaching features that provide tailored guidance and support based on user’s specific financial goals and challenges.

- Predictive analytics for spending habits: Apps could leverage machine learning to predict future spending patterns and alert users to potential overspending before it occurs, preventing further debt accumulation.

- Gamification of debt reduction: Incorporating game-like elements, such as rewards and challenges, to motivate users and make the debt repayment process more engaging.

- Enhanced security features: Implementing advanced security measures to protect users’ sensitive financial data from cyber threats.

Ultimate Conclusion

Successfully managing debt requires a proactive and organized approach, and budgeting apps with debt reduction planning tools provide the necessary structure and support. By leveraging the features offered by these apps—from visualizing debt to tracking progress and implementing effective repayment strategies—individuals can gain valuable insights into their spending habits, create realistic budgets, and accelerate their journey toward financial independence. Remember to choose an app that suits your needs and utilize its features effectively to maximize its benefits.

FAQ Overview: Best Budgeting Apps With Debt Reduction Planning Tools

Are these apps safe for my financial data?

Reputable apps employ robust security measures to protect user data. However, it’s essential to research the app’s privacy policy and security features before sharing sensitive financial information.

What if I don’t have a lot of technical experience?

Many budgeting apps are designed with user-friendliness in mind, offering intuitive interfaces and easy-to-understand features. Look for apps with clear tutorials and excellent customer support.

Can I use these apps with multiple bank accounts?

Most apps support linking multiple accounts, providing a comprehensive overview of your finances. Check the app’s specifications to confirm its compatibility with your specific banking institutions.

How often should I review my budget and debt repayment plan?

Regular review is crucial. Aim for at least a monthly review to adjust your plan based on your progress and changing circumstances.