Free Personal Finance Apps with Investment Tracking Features

Free personal finance apps with investment tracking features are revolutionizing how individuals manage their finances. The increasing popularity of these apps stems from their accessibility, convenience, and the ability to consolidate various financial aspects into a single, user-friendly platform. These apps offer a range of features designed to simplify budgeting, monitor spending, and, crucially, track investment performance, empowering users to make informed financial decisions.

This exploration will delve into the key features, benefits, and potential drawbacks of these increasingly essential tools.

This surge in popularity is fueled by several factors, including the rise of mobile technology, increased financial literacy, and a desire for greater control over personal finances. The ability to track investments in real-time, receive personalized financial insights, and set financial goals directly within an app provides significant advantages over traditional methods. Common features often include secure account linking, customizable budgeting tools, investment portfolio tracking, and reporting capabilities, all contributing to a more streamlined and informed financial management experience.

Introduction to Free Personal Finance Apps with Investment Tracking

The popularity of free personal finance apps has exploded in recent years, driven by the increasing accessibility of smartphones and the growing desire for individuals to take control of their financial well-being. These apps offer a convenient and user-friendly way to manage personal finances, making complex tasks like budgeting, expense tracking, and debt management significantly simpler. The integration of investment tracking features further enhances their appeal, transforming them into powerful tools for both novice and experienced investors.Utilizing apps for investment tracking provides several key advantages.

These apps offer real-time portfolio updates, eliminating the need for manual calculations and providing a clear, consolidated view of investment performance. They often include features that simplify the process of analyzing investment returns, identifying potential risks, and making informed decisions. Furthermore, many apps provide educational resources and insights, helping users to improve their financial literacy and investment strategies.

This accessibility empowers individuals to actively participate in their financial future, regardless of their prior experience.

Common Features of Free Personal Finance Apps with Investment Tracking

Free personal finance apps typically include a range of features designed to streamline financial management and investment tracking. These features vary depending on the specific app, but many incorporate core functionalities that cater to a wide range of users. A comprehensive understanding of these common features is essential for selecting an app that best suits individual needs and preferences.

Investment Portfolio Tracking

This core function allows users to link their brokerage accounts to the app, automatically importing their investment holdings. The app then aggregates this data to present a comprehensive overview of the portfolio’s composition, including asset allocation, individual holdings, and overall value. Many apps provide customizable dashboards, allowing users to tailor the displayed information to their specific preferences. For example, an investor might prioritize viewing their portfolio’s performance against a benchmark index, while another might focus on the distribution of assets across different investment categories.

Expense and Income Tracking

While not directly related to investment tracking, robust expense and income tracking is a vital component of effective personal finance management. Many apps integrate these features, allowing users to categorize transactions, set budgets, and monitor their spending habits. This integrated approach provides a holistic view of an individual’s financial situation, highlighting potential areas for improvement in both spending and investing.

Linking bank accounts and credit cards facilitates automated transaction recording, minimizing manual data entry and enhancing accuracy.

Financial Goal Setting and Progress Tracking

Many apps offer tools for setting financial goals, such as saving for a down payment on a house or retirement planning. These tools often incorporate goal-oriented budgeting features, helping users allocate funds effectively to achieve their objectives. The apps track progress toward these goals, providing visual representations of progress and identifying potential areas where adjustments might be necessary.

This functionality encourages proactive financial planning and promotes a sense of accomplishment as users make progress toward their financial aspirations. For example, a user might set a goal to save $10,000 for a down payment within two years and track their progress through the app.

Top Features to Look For in a Free Investment Tracking App

Source: gadgets360cdn.com

Choosing the right free investment tracking app can significantly improve your financial management. However, not all free apps are created equal. Understanding key features is crucial to selecting an app that meets your needs and keeps your financial data secure and accessible. This section highlights essential features to consider when making your choice.

Data Security and User Privacy

Protecting your financial information is paramount. A reputable free investment tracking app will employ robust security measures, including strong encryption protocols (like AES-256) to safeguard your data both in transit and at rest. Look for apps that adhere to industry best practices for data security and clearly Artikel their privacy policies, explaining how they collect, use, and protect your personal information.

Transparency regarding data handling is a crucial indicator of a trustworthy app. Avoid apps that lack clear privacy policies or have questionable security practices. Consider apps that offer two-factor authentication for an extra layer of protection.

Real-Time Data Updates

Real-time data updates are essential for accurate investment tracking. Delayed data can lead to inaccurate portfolio valuations and potentially flawed investment decisions. A good free investment tracking app will fetch data frequently from various sources to ensure your portfolio reflects the most current market conditions. The frequency of updates (e.g., every few minutes, hourly) should be a key consideration.

Apps with delayed updates might offer a less accurate representation of your investment performance. For example, an app updating only once a day will not capture intraday price fluctuations, potentially leading to an inaccurate picture of your portfolio’s value.

Charting and Visualization Tools

Effective visualization tools are crucial for understanding your investment performance. Different apps offer varying charting capabilities. Some might offer simple line graphs displaying asset value over time, while others may provide more advanced tools, including candlestick charts, bar charts, and customizable timeframes. The ability to easily compare different assets’ performance visually is beneficial. Consider the ease of use and the range of customization options offered.

For instance, an app allowing you to zoom in on specific periods, add indicators (like moving averages), and download charts for external use offers a richer analytical experience. Apps lacking robust visualization features might hinder your ability to effectively analyze your investment progress.

Account Linking Capabilities

The ability to seamlessly link various financial accounts is a significant advantage. A good free investment tracking app should support linking to multiple brokerage accounts, bank accounts, and potentially retirement accounts (like 401(k)s or IRAs). This allows for a consolidated view of your entire financial picture, simplifying tracking and analysis. The app should also provide secure and reliable methods for connecting these accounts, ideally using industry-standard APIs and security protocols.

Limited account linking capabilities may necessitate manual data entry, which is time-consuming and prone to errors. For example, an app only supporting a limited number of brokerage platforms might not be suitable if you use multiple brokers.

Comparison of Popular Free Apps

Choosing the right free personal finance app with investment tracking can significantly simplify your financial management. Many excellent options exist, each with its strengths and weaknesses. This comparison aims to highlight key differences to help you make an informed decision. Consider your specific needs and preferences when evaluating these apps.

Popular Free Investment Tracking Apps

The following table compares five popular free personal finance apps with investment tracking capabilities. Note that features and availability can change, so always check the app’s website for the most up-to-date information.

| App Name | Key Features | Pros | Cons |

|---|---|---|---|

| Personal Capital | Investment tracking, retirement planning tools, net worth calculation, budgeting features. | Comprehensive features, user-friendly interface, excellent reporting. | Requires linking numerous accounts, some advanced features may require a paid subscription. |

| Mint | Investment tracking, budgeting, bill payment reminders, credit score monitoring. | Easy setup, integrates with many financial institutions, strong budgeting tools. | Can feel cluttered with ads, investment tracking features are less robust than dedicated investment apps. |

| Yahoo Finance | Investment tracking, real-time stock quotes, financial news, portfolio analysis. | Real-time data, extensive market coverage, free access to many features. | Interface can feel outdated, lacks robust budgeting or planning tools. |

| Robinhood | Investment tracking, commission-free trading (for stocks and ETFs), fractional shares. | Simple and intuitive interface, commission-free trading, excellent for beginners. | Limited investment options compared to other platforms, lacks advanced charting and analysis tools. |

| Stash | Investment tracking, fractional shares, robo-advisor features, educational resources. | Beginner-friendly, educational content, access to fractional shares. | Higher fees compared to some competitors, limited investment options beyond ETFs and stocks. |

User Interface and Ease of Use

Each app offers a different user experience. Personal Capital and Mint generally provide intuitive interfaces, making navigation and data input straightforward. Yahoo Finance’s interface, while functional, may feel less modern and visually appealing to some users. Robinhood boasts a clean and minimalist design, prioritizing simplicity for ease of use. Stash similarly offers a streamlined interface geared toward beginner investors.

The ease of use will largely depend on individual preferences and prior experience with financial apps.

Investment Type Handling, Free personal finance apps with investment tracking features

These apps generally handle various investment types. Personal Capital and Mint support a wide range of asset classes, including stocks, bonds, mutual funds, ETFs, and real estate (depending on account linkages). Yahoo Finance excels in tracking stocks and ETFs, providing real-time quotes and detailed charts. Robinhood primarily focuses on stocks and ETFs, offering fractional shares for easier investing.

Stash, while offering a range of ETFs, might have more limited options compared to more comprehensive platforms. The specific investment types supported and the level of detail provided vary between apps.

Data Security and Privacy Concerns

Storing your financial information on a mobile app, even a free one, presents inherent risks. While convenient, these apps require access to sensitive data, making them potential targets for cyberattacks and data breaches. Understanding these risks and implementing protective measures is crucial for safeguarding your financial well-being.The potential for data breaches is a significant concern. Malicious actors could exploit vulnerabilities in an app’s security to gain access to your personal financial details, including account numbers, balances, and investment holdings.

This information could be used for identity theft, fraudulent transactions, or other criminal activities. Furthermore, even with robust security measures in place, the possibility of accidental data leaks or human error remains. Data may be compromised due to vulnerabilities in the app’s code, inadequate server security, or employee negligence.

App Security Measures and User Best Practices

Protecting your financial data requires a multi-faceted approach encompassing both the app developer’s security measures and the user’s proactive steps. Robust security protocols implemented by app developers are the first line of defense. This includes employing encryption to protect data both in transit and at rest, using multi-factor authentication to verify user identities, and regularly conducting security audits to identify and address vulnerabilities.

From the user’s perspective, choosing apps with strong security reputations and implementing good security habits are vital.

Importance of Reviewing Privacy Policies

Before using any personal finance app, carefully reviewing the app’s privacy policy is essential. The privacy policy Artikels how the app collects, uses, shares, and protects your personal data. It should clearly state what data is collected, the purposes for which it is collected, and with whom it might be shared. Pay close attention to sections detailing data retention policies, data security measures, and your rights regarding access, correction, and deletion of your data.

A transparent and comprehensive privacy policy indicates a commitment to user data protection. Conversely, vague or overly broad language should raise red flags. Apps with unclear or insufficient privacy policies should be avoided.

Limitations of Free Apps

Free personal finance apps with investment tracking capabilities offer convenient access to budgeting and portfolio monitoring, but they naturally come with certain limitations compared to their paid counterparts. Understanding these limitations is crucial for making an informed decision about which type of app best suits your needs and financial literacy level. These limitations often stem from the need for free apps to generate revenue and balance user experience with resource constraints.Free apps often have fewer features than paid options.

This can include restrictions on the number of accounts linked, limited reporting capabilities, or a lack of advanced analytical tools such as sophisticated portfolio projections or tax optimization strategies. For example, a free app might only allow tracking of a single brokerage account, while a paid version would allow linking multiple accounts across different institutions. Similarly, a free app may provide basic transaction categorization, while a paid app might offer AI-powered, more accurate categorization and automated budgeting features.

The level of customer support may also be significantly reduced in free versions, often relying on FAQs or community forums instead of direct, personalized assistance.

App Monetization Strategies

Free apps typically employ several strategies to generate revenue. The most common is through in-app advertising. This might involve banner ads displayed throughout the app’s interface or targeted advertisements based on user data. Another common monetization strategy is offering premium features as a paid upgrade. These premium features might unlock advanced analytics, remove advertising, provide priority customer support, or offer unlimited account linking.

A third approach is data aggregation and anonymized data selling (while adhering to privacy regulations), although this is often less transparent to the user. For instance, a free app might offer basic investment tracking but charge for features like real-time portfolio valuations or advanced tax reporting. Some free apps also rely on affiliate marketing, earning commissions from purchases made through links within the app.

Feature-Cost Trade-offs

Choosing between a free and paid app involves weighing the features offered against the cost. Free apps are ideal for users with basic financial needs who primarily require simple budgeting and basic investment tracking. However, individuals with more complex financial situations or those who require advanced analytical tools and personalized support might find the limitations of free apps restrictive.

For example, a user with a diverse investment portfolio across multiple accounts and a need for detailed tax reporting might benefit from a paid app’s more comprehensive features, despite the associated cost. Ultimately, the decision depends on individual priorities and the value placed on specific features. A user with a simple investment portfolio might find a free app sufficient, while someone with complex investments and a need for extensive reporting might find the cost of a paid app justified by the enhanced capabilities.

Illustrative Examples of App Usage: Free Personal Finance Apps With Investment Tracking Features

Free personal finance apps with investment tracking capabilities offer users a streamlined way to manage their financial lives. These apps simplify complex processes, making investment monitoring and budgeting more accessible. Let’s explore two scenarios illustrating how these apps can be used effectively.

Investment Tracking Scenario

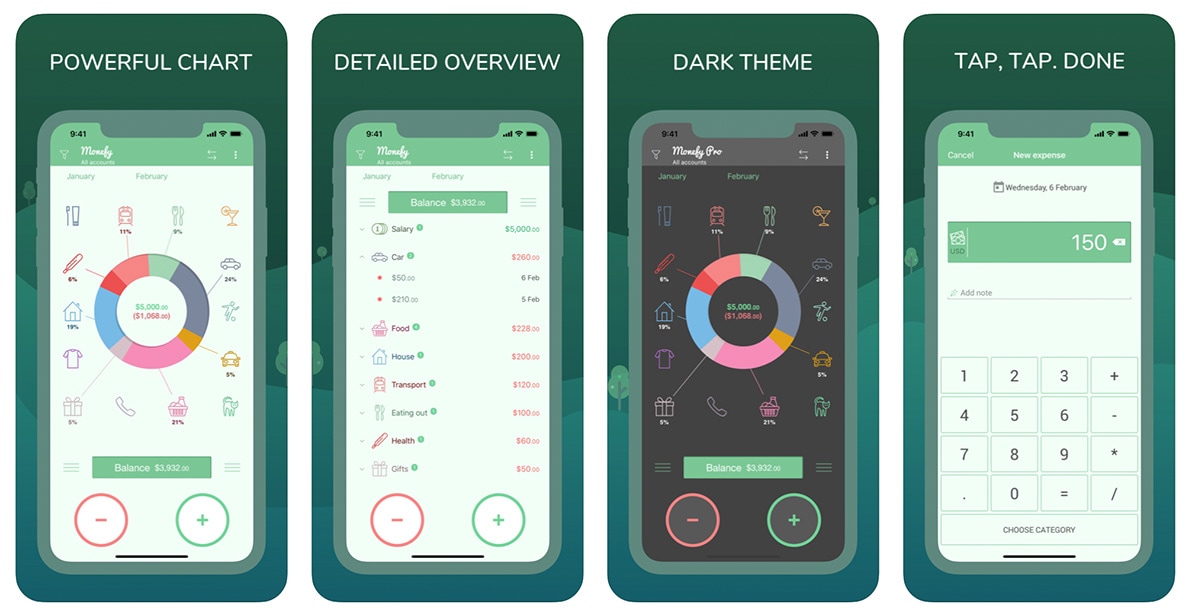

Imagine Sarah, a young professional, using a free app to track her investments. She begins by linking her brokerage accounts. The app, after secure authentication, automatically pulls in her portfolio holdings, displaying a summary screen showing the total value, allocation across different asset classes (e.g., stocks, bonds, mutual funds), and overall performance. A screenshot would show a clean, modern interface with a pie chart illustrating asset allocation (e.g., 60% stocks, 40% bonds), a bar graph displaying performance over time (e.g., a three-month performance of +5%), and a list of individual holdings with current prices and quantities.

Below this, a table displays the current value of each asset, alongside its purchase price and overall gain/loss. She then manually adds her individual retirement account (IRA) holdings, entering the ticker symbols and quantities. The app automatically updates the portfolio summary to reflect these additions. To generate a report, Sarah selects the “Reports” tab. She chooses a custom date range (e.g., the past year) and selects the report type (e.g., portfolio performance summary).

The generated report is a downloadable PDF showing detailed performance metrics, including total return, average annual return, and Sharpe ratio. A screenshot of the report would display a professional-looking document with clear charts and tables, summarizing her investment performance over the selected period.

Budgeting and Goal Setting Scenario

Next, consider David, who wants to save for a down payment on a house. He uses the app’s budgeting features to track his income and expenses. He categorizes his transactions automatically, and the app provides visual representations of his spending habits through charts and graphs. A screenshot of this would show a bar chart categorizing expenses (e.g., housing, food, transportation) and a line graph showing income versus expenses over time.

He sets a financial goal – saving $50,000 in three years for a down payment. The app calculates the required monthly savings amount and creates a personalized savings plan. A screenshot of the goal-setting section would display a clear overview of the goal (e.g., $50,000 down payment), the timeline (e.g., 3 years), the required monthly savings amount, and a progress bar showing how much he has saved so far.

The app then allows him to track his progress towards this goal, providing regular updates and notifications. It also allows him to adjust the goal or timeline as needed, keeping his savings plan dynamic and adaptable to his changing circumstances.

Future Trends in Free Personal Finance Apps

The landscape of free personal finance apps is constantly evolving, driven by advancements in technology and shifting user expectations. We can anticipate significant improvements in functionality, personalization, and security in the coming years, largely fueled by the integration of artificial intelligence and machine learning. These developments promise to make managing personal finances even more accessible and efficient for everyone.The next generation of these apps will likely leverage powerful technological advancements to offer a more sophisticated and intuitive user experience.

AI and Machine Learning Integration

Artificial intelligence and machine learning will play a crucial role in shaping the future of free personal finance apps. AI-powered features could include intelligent budgeting suggestions based on spending patterns, predictive analytics for forecasting future expenses, and personalized investment recommendations tailored to individual risk tolerance and financial goals. For example, an app could analyze a user’s spending history to automatically categorize transactions and suggest areas where budget adjustments might be beneficial.

Machine learning algorithms could also improve the accuracy of investment projections and identify potential risks or opportunities. Imagine an app that not only tracks your investments but also proactively alerts you to potential market shifts or suggests adjustments to your portfolio based on your long-term goals. This level of personalized financial guidance was previously only available through expensive financial advisors.

Enhanced Security and Privacy Features

With increasing concerns about data security and privacy, future free personal finance apps will need to prioritize robust security measures. This includes implementing advanced encryption techniques, multi-factor authentication, and regular security audits. We might see the integration of biometric authentication methods, such as fingerprint or facial recognition, for added security. Furthermore, apps will likely become more transparent about their data collection practices, providing users with greater control over their data.

This enhanced transparency and control will build user trust and encourage wider adoption. For example, users might be given the option to selectively share data with third-party services, allowing for a more granular level of privacy management.

New Feature Integrations

Beyond AI and security enhancements, we can expect several new features to emerge in free personal finance apps. These could include integrated tax preparation tools, automated bill payment systems, and seamless integration with other financial institutions. Gamification techniques could also be incorporated to make managing finances more engaging and motivating. For instance, an app could reward users for reaching financial goals with virtual badges or points, fostering a positive feedback loop that encourages responsible financial behavior.

Furthermore, the incorporation of real-time market data and personalized financial news feeds could empower users to make more informed financial decisions. The integration of features like carbon footprint tracking linked to spending habits could also appeal to environmentally conscious users, allowing them to understand the environmental impact of their financial choices.

Conclusion

Ultimately, the choice of a free personal finance app with investment tracking capabilities depends on individual needs and priorities. While free apps offer valuable tools for managing finances and monitoring investments, it’s crucial to be aware of their limitations and potential risks. Careful consideration of data security, feature limitations, and monetization strategies is vital. By understanding the strengths and weaknesses of various apps and prioritizing user privacy and security, individuals can leverage these technologies to enhance their financial well-being and achieve their financial goals effectively and responsibly.

Detailed FAQs

What data security measures should I look for in a free investment tracking app?

Look for apps that utilize robust encryption methods, two-factor authentication, and transparent privacy policies detailing how your data is collected, used, and protected.

Are free apps as accurate as paid alternatives for investment tracking?

Accuracy depends more on the data source than the app itself. Free apps may have slightly delayed updates or fewer data points compared to paid versions, but reputable apps generally offer reliable data.

How do free investment tracking apps make money?

Many free apps generate revenue through advertisements, affiliate marketing, or by offering premium features for a subscription fee. Some may also sell aggregated, anonymized user data.

What happens if a free app I use shuts down?

Data loss is a possibility. Regularly back up your data, and consider exporting your portfolio information to a spreadsheet or another app periodically.

Can I use these apps to track investments outside of traditional brokerage accounts (e.g., cryptocurrency)?

Some apps support a wider range of asset classes than others. Check the app’s features to ensure it supports the specific investments you want to track.