Reliable Finance Apps for Small Business Accounting Needs

Reliable finance apps for small business accounting needs are transforming how entrepreneurs manage their finances. Efficiently handling finances is crucial for small businesses to thrive, yet many struggle with the complexities of accounting, budgeting, and invoicing. This guide explores the essential features of reliable finance apps, helping small business owners select the right tools to streamline their financial operations and achieve greater success.

From tracking expenses and generating invoices to managing cash flow and integrating with other business tools, these apps offer a range of solutions tailored to the specific needs of small businesses. We’ll delve into popular app categories, selection criteria, data security considerations, and illustrative examples of real-world app usage, equipping you with the knowledge to make informed decisions about your financial technology.

Introduction to Reliable Finance Apps

Effective financial management is crucial for the success and longevity of any small business. Without a clear understanding of income, expenses, and cash flow, even the most innovative business idea can falter. Robust financial records are essential for making informed business decisions, securing loans, attracting investors, and ensuring compliance with tax regulations. Ignoring financial management can lead to missed opportunities, financial instability, and ultimately, business failure.Small businesses often face unique challenges in managing their finances.

Many owners lack the time, expertise, or resources to dedicate to complex accounting tasks. They may struggle with juggling multiple roles, wearing many hats within their business, and finding time for what is often seen as a less glamorous but crucial task. Furthermore, the initial investment in accounting software or hiring a professional accountant can seem prohibitive, especially for startups with limited budgets.

The ever-changing landscape of tax laws and regulations adds another layer of complexity, requiring constant updates and careful adherence. Finally, reconciling multiple bank accounts, managing invoices, and tracking expenses across various platforms can become a time-consuming and error-prone process.

Efficiently managing finances is crucial for small businesses, requiring reliable accounting apps to track income and expenses. For businesses involved in food delivery, accurate record-keeping is especially important, and integrating data from platforms like those listed on Food Delivery Apps is key. Therefore, selecting the right finance app becomes even more critical for ensuring a clear financial picture and informed decision-making.

Common Financial Tasks for Small Businesses

Small business owners need to handle a variety of financial tasks on a regular basis. These tasks are vital for maintaining accurate financial records and ensuring the smooth operation of the business. Efficient management of these tasks directly impacts profitability and long-term sustainability.

- Tracking Income and Expenses: This involves meticulously recording all sales, purchases, and other financial transactions. Accurate tracking is essential for calculating profit margins, identifying areas for cost reduction, and preparing accurate tax returns.

- Managing Invoicing and Payments: Creating and sending invoices promptly, tracking payments received, and following up on outstanding invoices are crucial for maintaining a healthy cash flow. Efficient invoicing processes reduce late payments and improve overall financial health.

- Reconciling Bank Accounts: Regularly comparing bank statements with internal records ensures accuracy and helps identify discrepancies or potential fraudulent activities. This process helps maintain a clear picture of the business’s financial position.

- Payroll Management: Calculating and paying employee wages accurately and on time is a critical legal and financial responsibility. Failure to do so can lead to penalties and damage employee morale.

- Preparing Financial Reports: Generating regular financial reports, such as income statements, balance sheets, and cash flow statements, provides valuable insights into the business’s financial performance and helps in strategic decision-making. These reports are also necessary for tax filings and investor presentations.

Key Features of Reliable Finance Apps

Choosing the right finance app can significantly streamline your small business’s accounting processes. A reliable app should offer a suite of features designed to simplify tasks, improve accuracy, and save you valuable time. This section will explore five essential features to look for.

Several key features differentiate a truly reliable finance app from a merely functional one. These features contribute to efficient bookkeeping, accurate financial reporting, and improved decision-making. By understanding these features and their benefits, small business owners can select an application perfectly suited to their needs.

Automated Expense Tracking

Automated expense tracking is a crucial feature, saving significant time and effort compared to manual entry. The app automatically categorizes transactions based on merchant information or user-defined rules. For example, purchases from office supply stores are automatically categorized as “Office Supplies,” while transactions from restaurants are categorized as “Meals & Entertainment.” This automated categorization significantly reduces the time spent manually reviewing and classifying each transaction.

This feature also minimizes the risk of human error in data entry, leading to more accurate financial records. Furthermore, some apps allow for receipt capture and automatic data extraction, further streamlining the process.

Invoicing and Payment Processing

Efficient invoicing and payment processing are essential for timely cash flow. A reliable app allows you to create and send professional-looking invoices quickly, often with customizable branding. It also integrates with various payment gateways, enabling clients to pay directly through the app using credit cards, debit cards, or other digital payment methods. For example, an app might integrate with Stripe or PayPal, providing multiple payment options for clients and accelerating payment collection.

This integrated system reduces the administrative burden of managing invoices and payments, ultimately improving cash flow and reducing late payments.

Financial Reporting and Analytics

Access to clear and concise financial reports is vital for informed decision-making. Reliable apps provide various reporting options, such as profit and loss statements, balance sheets, and cash flow statements. These reports are usually customizable, allowing users to filter data by date, category, or other criteria. For example, a business owner can generate a report showing expenses for a specific month or analyze sales trends over a quarter.

This feature empowers small business owners to monitor their financial health, identify areas for improvement, and make data-driven decisions. Some apps also provide insightful analytics, such as identifying top-performing products or services or highlighting areas of high expenditure.

Choosing the right reliable finance apps for small business accounting needs is crucial for efficient management. Understanding the nuances of financial software can be challenging, so supplementing practical experience with educational resources is highly beneficial. For instance, exploring resources like Education Apps can provide valuable insights into best practices. Ultimately, the selection of the right finance app, coupled with continuous learning, will streamline your small business accounting.

Bank Reconciliation

Bank reconciliation is a crucial process for ensuring the accuracy of financial records. A reliable finance app should automate or significantly simplify this process. The app automatically matches transactions from the bank statement with those recorded in the app, highlighting any discrepancies. This reduces the risk of errors and ensures that the financial records accurately reflect the bank balance.

For instance, if a transaction is recorded in the app but not reflected in the bank statement, the app flags this discrepancy, allowing for prompt investigation and correction. This automated process saves considerable time and effort compared to manual reconciliation.

Inventory Management

For businesses that handle inventory, a reliable finance app should integrate inventory tracking capabilities. This allows for real-time monitoring of stock levels, tracking of sales, and forecasting of future needs. For example, a retail business can track the number of units sold, monitor stock levels, and automatically generate purchase orders when stock falls below a certain threshold. This prevents stockouts, optimizes inventory levels, and reduces storage costs.

Effective inventory management contributes to increased efficiency and profitability.

| Feature | Xero | QuickBooks Self-Employed | FreshBooks |

|---|---|---|---|

| Automated Expense Tracking | Excellent; integrates with bank accounts and credit cards | Good; manual categorization still required for some transactions | Good; offers receipt capture and some automated categorization |

| Invoicing & Payment Processing | Excellent; supports multiple payment gateways and customizable invoices | Good; basic invoicing features, integrates with PayPal | Excellent; professional invoices, multiple payment options |

| Financial Reporting | Excellent; wide range of customizable reports and dashboards | Good; basic reports available, suitable for simpler needs | Good; provides key financial reports, customizable to some extent |

Popular Finance App Categories: Reliable Finance Apps For Small Business Accounting Needs

Small businesses rely heavily on efficient financial management, and a variety of finance apps cater to these needs. Choosing the right app often depends on the specific business requirements and the stage of growth. Understanding the different categories of finance apps available can help streamline operations and improve financial clarity.

Several categories of finance apps are crucial for small business accounting. Each category offers specialized tools to manage specific aspects of financial operations, from tracking expenses to generating invoices. Effective utilization of these apps can significantly improve efficiency and accuracy in financial record-keeping.

Accounting Software

Accounting software provides a comprehensive solution for managing all aspects of a business’s finances. These apps typically offer features beyond basic bookkeeping, including financial reporting, tax preparation assistance, and inventory management.

Managing finances for a small business requires reliable accounting apps, offering features like invoicing and expense tracking. However, remember that effective marketing is also crucial, and that often involves leveraging the power of social media; for instance, exploring different platforms is easily done via a resource like Social Media Apps. Ultimately, combining strong accounting software with a smart social media strategy is key to sustainable small business growth.

- Example: Xero

-Offers features such as invoicing, expense tracking, bank reconciliation, and financial reporting. It’s known for its user-friendly interface and integration capabilities. - Example: QuickBooks Self-Employed

-A simplified version of QuickBooks designed for freelancers and solopreneurs. It focuses on expense tracking, mileage tracking, and income reporting, making it ideal for simpler accounting needs.

Pros: Comprehensive financial management, automated processes, improved accuracy, facilitates tax preparation.

Cons: Can be expensive, requires a learning curve, may be overkill for very small businesses with minimal financial transactions.

Invoicing Apps

Invoicing apps simplify the process of creating and sending invoices to clients. They often include features for tracking payments, managing outstanding invoices, and generating reports on revenue.

- Example: FreshBooks

-Offers professional-looking invoices, automated payment reminders, and time tracking capabilities. It also integrates with other business tools. - Example: Zoho Invoice

-A feature-rich invoicing app that includes expense tracking, recurring invoicing, and client management tools.

Pros: Streamlines invoicing, reduces administrative burden, improves cash flow management, professional presentation.

Cons: May require integration with other apps for complete financial management, some features may require paid subscriptions.

Managing finances for a small business can be challenging, but thankfully, reliable finance apps offer a streamlined solution. Finding the right tools is key, and a great place to start your search is by exploring the diverse options available at Finance Apps. These apps can help simplify accounting tasks, improve cash flow management, and ultimately contribute to the overall financial health of your small business.

Choosing the right app can significantly impact your efficiency and accuracy.

Budgeting Apps

Budgeting apps help businesses track income and expenses to create and monitor budgets. They often offer features for forecasting, identifying areas for cost savings, and visualizing financial performance.

- Example: You Need a Budget (YNAB)

– Emphasizes mindful spending and goal-oriented budgeting. It helps users allocate funds to specific categories and track progress towards financial goals. - Example: Mint

-A free budgeting app that connects to bank accounts and credit cards to automatically track transactions. It provides a clear overview of spending habits and helps users identify areas for improvement.

Pros: Improves financial awareness, facilitates better financial planning, identifies potential cost savings, enhances control over finances.

Cons: Requires regular input and updates, accuracy depends on accurate data entry, free versions may have limited features.

Expense Tracking Apps

Expense tracking apps simplify the process of recording and categorizing business expenses. They often integrate with bank accounts and credit cards to automatically import transactions, simplifying the process of expense reporting.

- Example: Expensify

– Automates expense reporting, offering features like receipt scanning, mileage tracking, and integration with accounting software. - Example: QuickBooks Self-Employed (mentioned above)

-Also includes robust expense tracking capabilities.

Pros: Streamlines expense tracking, reduces manual data entry, improves accuracy of expense reports, facilitates tax preparation.

Cons: Requires integration with other apps for complete financial management, some features may require paid subscriptions, data accuracy depends on proper use.

Managing finances is crucial for small businesses, and reliable accounting apps are essential for this. Many such apps seamlessly integrate with other business tools, particularly those handling online sales; for instance, efficient integration is often found with platforms offering E-commerce Apps. Therefore, choosing the right finance app can significantly streamline your operations and improve your overall financial health.

App Selection Criteria for Small Businesses

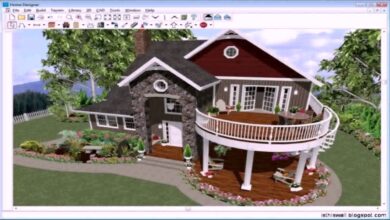

Source: businessnewsdaily.com

Choosing the right finance app can significantly impact a small business’s efficiency and financial health. The decision shouldn’t be taken lightly, as the wrong app can lead to wasted time, increased errors, and even security vulnerabilities. Careful consideration of several key factors is crucial for selecting a solution that truly meets the business’s needs.Selecting the optimal finance app involves a multifaceted evaluation process.

Small businesses must weigh various factors to ensure a seamless integration into their existing workflows and a secure platform for managing their finances. This includes a thorough assessment of cost, ease of use, integration capabilities, and security features.

Cost Considerations for Finance Apps

Pricing models for finance apps vary considerably. Some offer a tiered system based on features or user numbers, while others charge a flat monthly or annual fee. Free options often exist, but typically come with limitations on features or transaction volume. A crucial aspect is understanding the total cost of ownership, including any additional fees for premium features, integrations, or customer support.

Efficient small business accounting relies heavily on reliable finance apps to manage finances effectively. These apps often integrate with other productivity tools to streamline workflows, and exploring options like those listed on this helpful resource for Productivity Apps can significantly improve your overall efficiency. Ultimately, selecting the right finance app can make a considerable difference in managing your small business’s financial health.

For example, one app might offer a basic free plan with limited transaction tracking, while a paid plan unlocks features like inventory management and invoicing. Another might offer a single, all-inclusive monthly fee, regardless of transaction volume. Businesses should compare the value proposition of different pricing models to determine the most cost-effective option that aligns with their needs and budget.

Ease of Use and User Interface

The user interface (UI) and overall ease of use are paramount. A complex or poorly designed app can lead to frustration and wasted time, hindering productivity. Before committing to a specific app, small business owners should explore the interface, test its functionality, and ensure it aligns with their technological proficiency. Look for intuitive navigation, clear labeling, and helpful tutorials.

Consider the time investment required for training employees on the app. A user-friendly app minimizes the learning curve, allowing employees to focus on core business tasks rather than grappling with complicated software.

Integration with Other Business Tools

Seamless integration with existing accounting software, CRM systems, or e-commerce platforms is a significant advantage. This integration streamlines workflows and eliminates the need for manual data entry, reducing the risk of errors and saving valuable time. For instance, if a business uses a specific CRM, the finance app should ideally integrate with it to automatically update customer information and transaction details.

Consider the availability of APIs (Application Programming Interfaces) and the extent of integration offered by different apps. Prioritize apps that offer robust integration capabilities to optimize business processes.

Security Features of Finance Apps

Protecting sensitive financial data is critical. Small businesses should thoroughly investigate the security features offered by potential finance apps. Look for apps that utilize encryption to protect data both in transit and at rest. Two-factor authentication (2FA) adds an extra layer of security, making it harder for unauthorized individuals to access the account. Regular security audits and updates demonstrate a commitment to data protection.

Investigate the app provider’s security policies and their track record in handling data breaches. Choose apps with a proven history of prioritizing data security and compliance with relevant regulations like GDPR or CCPA.

Integration with Other Business Tools

Seamless integration between your finance app and other business tools is crucial for optimizing your small business operations. A fragmented system, where data resides in disparate platforms, leads to inefficiencies, errors, and lost time. Connecting your finance app to other essential tools creates a unified, streamlined workflow, significantly boosting productivity and accuracy.The benefits of integrated systems are numerous.

Imagine automatically importing sales data from your e-commerce platform directly into your accounting software, eliminating manual data entry and the associated risk of human error. Or picture instantly accessing customer information from your CRM within your invoicing app, improving communication and speeding up payment processes. This level of interconnectedness empowers data-driven decision-making, providing a clearer and more comprehensive view of your business’s financial health.

Examples of Apps with Strong Integration Capabilities

Several leading finance apps offer robust integration capabilities, connecting with a wide range of popular business tools. For example, Xero integrates seamlessly with various e-commerce platforms like Shopify and WooCommerce, CRM systems like HubSpot and Salesforce, and project management tools like Asana and Trello. Similarly, QuickBooks Online boasts extensive integration options, connecting with numerous applications across various business functions.

These integrations allow for automated data transfer, reducing manual work and minimizing the chance of discrepancies. Other examples include Zoho Books, which offers a broad suite of integrated tools, and FreshBooks, known for its user-friendly interface and integrations with popular platforms.

Streamlining Workflows and Improving Efficiency Through Integration

Integration dramatically streamlines workflows by automating repetitive tasks. For instance, integrating your e-commerce platform with your accounting software automatically records sales transactions, updates inventory levels, and generates invoices. This automation eliminates the need for manual data entry, saving significant time and resources. Furthermore, integration improves data accuracy by reducing the risk of human error associated with manual data entry and reconciliation.

By centralizing data in one system, businesses gain a more accurate and real-time view of their financial performance, leading to better informed decisions and improved efficiency. For example, a small bakery using integrated systems can track inventory levels in real-time, ensuring they always have enough ingredients on hand, while simultaneously tracking sales data to optimize pricing and product offerings.

This real-time visibility allows for proactive adjustments and optimized resource allocation, directly impacting the bottom line.

Data Security and Privacy in Finance Apps

Protecting your small business’s financial data is paramount. Choosing a finance app with robust security measures is crucial to prevent data breaches and maintain compliance with regulations. The right app will offer multiple layers of protection, ensuring your sensitive information remains confidential and secure.The importance of data encryption and adherence to relevant regulations like GDPR and CCPA cannot be overstated.

Data encryption safeguards your financial information even if a breach occurs, rendering the stolen data unusable. Compliance with regulations demonstrates your commitment to data protection and avoids potential legal repercussions. Failing to prioritize these aspects can lead to significant financial losses and reputational damage.

Data Encryption Methods

Strong encryption is essential. Look for apps that utilize at least 256-bit AES encryption for data at rest and in transit. This industry-standard encryption method makes it extremely difficult for unauthorized individuals to access your financial information. Furthermore, the app should clearly state its encryption methods in its security documentation. Apps should also use secure protocols like HTTPS to protect data during transmission.

For example, a reputable app might use TLS 1.3 or later for secure communication.

Regulatory Compliance

Compliance with relevant data privacy regulations is a must. Apps should explicitly state their compliance with regulations such as GDPR (General Data Protection Regulation) for European data and CCPA (California Consumer Privacy Act) for California data. This demonstrates a commitment to handling your data responsibly and adhering to legal standards. Verifying this compliance involves checking the app’s privacy policy and security documentation for specific mentions of these regulations and the security measures implemented to meet their requirements.

Failure to comply can lead to significant fines and legal challenges.

Security Questions for App Providers

Before selecting a finance app, small businesses should proactively ask providers specific security questions. This proactive approach helps ensure the app provider takes security seriously and is transparent about its practices.

- What encryption methods are used to protect data at rest and in transit?

- What security certifications does the app possess (e.g., ISO 27001)?

- What measures are in place to detect and respond to security incidents?

- What is the app’s policy on data retention and deletion?

- What security training do your employees receive regarding data protection?

- How does the app protect against unauthorized access and malware?

- What is the app’s process for handling data breaches, including notification procedures?

- Which specific regulations (GDPR, CCPA, etc.) does the app comply with, and how is this compliance verified?

- What third-party security audits has the app undergone, and what were the results?

- What is the app’s disaster recovery plan to ensure data availability in case of outages or emergencies?

Illustrative Examples of App Use Cases

Small business owners often face numerous financial challenges. Utilizing a reliable finance app can streamline processes, improve accuracy, and ultimately save time and money. The following scenarios illustrate how different apps can be used to solve common business problems.

Tracking Expenses for a Freelance Writer

This scenario details how a freelance writer uses a finance app to meticulously track their business expenses. Accurate expense tracking is crucial for tax purposes and understanding overall profitability.

Let’s say Sarah, a freelance writer, uses a finance app to categorize and track all her business expenses. Each time she incurs a business expense, she enters the details into the app: date, description (e.g., “Coffee shop meeting with client,” “Software subscription”), amount, and payment method. The app automatically categorizes expenses (e.g., “Client Entertainment,” “Software,” “Office Supplies”). At the end of the month, Sarah generates a report to see a breakdown of her expenses by category, enabling her to identify areas where she might be overspending.

The app also allows her to export this data for tax preparation.

Illustrative Image: The image depicts a smartphone screen displaying a categorized expense report. Different colored bars represent different expense categories (e.g., travel, marketing, software) with their respective amounts clearly shown. A total expense figure is prominently displayed at the bottom. The app’s interface is clean and intuitive, with clear labels and easy-to-understand charts.

Generating Invoices for a Pet Sitter

This example demonstrates how a pet sitter uses a finance app to efficiently create and manage invoices for their services. Accurate and timely invoicing is critical for getting paid promptly.

John, a pet sitter, uses the app to create professional invoices for each client. For each pet-sitting job, he enters client details (name, address, contact information), the dates of service, the services provided (e.g., dog walking, pet feeding, overnight stays), and the hourly or daily rate. The app automatically calculates the total amount due and generates a professional-looking invoice that can be sent directly to the client via email or text message.

John can track outstanding invoices within the app, easily identifying which clients haven’t paid yet. The app also integrates with his bank account, allowing him to track payments received.

Illustrative Image: The image shows a clean, professional-looking invoice on a tablet screen. The invoice includes the pet sitter’s logo and contact information, the client’s details, a detailed list of services rendered with corresponding prices, and the total amount due. A clear payment due date is also displayed. The overall design is modern and easy to read.

Managing Cash Flow for an Online Bookstore, Reliable finance apps for small business accounting needs

This scenario highlights how an online bookstore owner can use a finance app to monitor their cash flow and make informed financial decisions. Effective cash flow management is essential for business sustainability.

Maria, who runs an online bookstore, uses a finance app to track her income and expenses, providing a real-time overview of her cash flow. The app integrates with her online store’s sales data, automatically recording sales and payments received. She also manually enters her expenses, categorizing them as previously described. The app then generates a cash flow statement showing the inflow and outflow of cash over a specified period.

This helps Maria identify potential cash shortages and make informed decisions about expenses, inventory management, and potential investments.

Illustrative Image: The image displays a graph on a laptop screen illustrating Maria’s cash flow over the past three months. The graph clearly shows periods of positive and negative cash flow, highlighting peaks and valleys. Key financial metrics, such as total income, total expenses, and net cash flow, are displayed alongside the graph, providing a clear summary of Maria’s financial health.

The app’s interface is user-friendly, with clear visuals and easily accessible data.

Outcome Summary

Selecting the right finance app can significantly impact a small business’s financial health and overall efficiency. By carefully considering the key features, integration capabilities, and security measures discussed in this guide, small business owners can confidently choose a solution that streamlines their accounting processes, improves financial management, and ultimately contributes to their long-term success. Remember to prioritize ease of use, robust security, and seamless integration with other business tools for optimal results.

Common Queries

What are the typical costs associated with small business finance apps?

Pricing models vary widely, from free apps with limited features to subscription-based services with tiered pricing depending on the number of users or features. Some apps offer free trials, allowing businesses to test the software before committing to a paid plan.

How can I ensure the data security of my chosen finance app?

Look for apps that employ robust security measures, including data encryption, two-factor authentication, and regular security updates. Check for compliance with relevant data privacy regulations (e.g., GDPR, CCPA). It’s also wise to read user reviews and check the app provider’s security policies.

What if I need help using a particular finance app?

Most reputable finance apps offer customer support through various channels, such as email, phone, or online help centers. Look for apps with comprehensive documentation and tutorials to assist with onboarding and troubleshooting.

Can I switch finance apps if I’m unhappy with my current one?

Yes, you can usually switch finance apps. However, migrating data from one app to another may require some effort. Before switching, ensure the new app offers a smooth data import process or consider exporting your data in a compatible format.

Are there any free finance apps suitable for small businesses?

Yes, several free finance apps exist, but they often have limitations in features or user capacity compared to paid options. Free apps might include advertisements or offer only basic accounting functionalities. Carefully evaluate the features offered before choosing a free app.