Tax Implications of Cryptocurrency Trading

Tax implications of cryptocurrency trading present a unique set of challenges for both investors and tax professionals. The volatile nature of cryptocurrencies, coupled with the relatively nascent regulatory landscape, creates complexities not found in traditional asset classes. Understanding how to properly categorize cryptocurrency transactions, calculate capital gains and losses, and navigate the intricacies of reporting requirements is crucial for compliance and minimizing tax liabilities.

This guide aims to demystify the tax treatment of cryptocurrency, providing a comprehensive overview of the key considerations and best practices.

From defining cryptocurrencies for tax purposes and addressing the nuances of mining and staking rewards to navigating international tax implications and the complexities of decentralized finance (DeFi) activities, we will explore the various aspects of cryptocurrency taxation. We will delve into the specific tax forms and schedules required for reporting, as well as the potential penalties for non-compliance. This exploration will equip individuals and businesses with the knowledge necessary to confidently navigate the evolving tax landscape surrounding cryptocurrency trading.

Defining Cryptocurrency for Tax Purposes

Understanding the tax implications of cryptocurrency trading requires a clear definition of what constitutes cryptocurrency for tax purposes. This isn’t always straightforward, as the digital asset landscape is constantly evolving. This section clarifies the classification of different cryptocurrencies and their associated tax treatments.Cryptocurrencies, for tax purposes, are generally considered property. This means they are not treated the same as fiat currencies (like the US dollar or the Euro) but rather like other assets such as stocks or precious metals.

Their value fluctuates, and transactions involving them are subject to capital gains taxes. The specific type of cryptocurrency doesn’t fundamentally change this classification, though the specifics of how gains are calculated might vary depending on the nature of the transaction.

Types of Cryptocurrencies and Tax Classification

Various cryptocurrencies exist, each with unique characteristics. However, for tax purposes, the distinctions are less about the specific cryptocurrency (Bitcoin, Ethereum, Litecoin, etc.) and more about the nature of the transaction. Whether it’s a direct purchase, a trade for another cryptocurrency, or receipt as payment for goods or services, the underlying tax treatment remains largely consistent: as a taxable event.

The IRS, for example, considers all virtual currencies to be property for tax purposes.

Tax Treatment of Airdrops and Hard Forks

Airdrops, where a cryptocurrency project distributes tokens to existing holders of another cryptocurrency, and hard forks, where a blockchain splits into two separate chains, creating a new cryptocurrency, present unique tax scenarios. In both cases, the newly received cryptocurrency is generally considered taxable income at its fair market value at the time of receipt. This is because the recipient has acquired an asset of value without any direct cost.

For example, if you receive 100 units of a new cryptocurrency worth $10 each during an airdrop, you would have a taxable event of $1000. Similarly, if a hard fork results in the creation of new tokens, the value of these tokens at the time of the fork would be considered income.

Categorizing Cryptocurrency Transactions for Tax Reporting

Accurately categorizing cryptocurrency transactions is crucial for correct tax reporting. Here are some examples:* Buying Cryptocurrency: Purchasing cryptocurrency with fiat currency is considered a cost basis transaction. The cost basis is the amount of fiat currency spent.

Selling Cryptocurrency

Selling cryptocurrency for fiat currency triggers a taxable event. The gain or loss is calculated as the difference between the selling price and the cost basis.

Trading Cryptocurrency

Exchanging one cryptocurrency for another is also a taxable event. The gain or loss is determined by comparing the fair market value of the received cryptocurrency at the time of the trade to the cost basis of the cryptocurrency traded.

Understanding the tax implications of cryptocurrency trading requires careful consideration of various factors, including capital gains and losses. To put this into a broader context, consider the evolution of financial regulations in the United States, as charted on this helpful US history timeline ; seeing how regulations have changed over time provides valuable perspective on the complexities of modern financial instruments like cryptocurrencies.

Ultimately, navigating these tax complexities necessitates professional advice to ensure compliance.

Receiving Cryptocurrency as Payment

Receiving cryptocurrency as payment for goods or services is considered taxable income at the fair market value of the cryptocurrency at the time of receipt.

Mining Cryptocurrency

Mining cryptocurrency is considered taxable income based on the fair market value of the cryptocurrency mined at the time of mining.

Comparison of Cryptocurrency and Traditional Asset Tax Treatment

The following table compares the tax treatment of cryptocurrency to traditional assets like stocks and bonds:

| Asset Type | Capital Gains Treatment | Tax Reporting Requirements | Example |

|---|---|---|---|

| Cryptocurrency | Short-term or long-term capital gains/losses, depending on holding period (generally, over one year is long-term). | Reported on Schedule 8949 (Form 1040) and Schedule D (Form 1040). Detailed records of transactions are required. | Selling Bitcoin for a profit after holding it for six months. |

| Stocks | Short-term or long-term capital gains/losses, depending on holding period. | Reported on Schedule 8949 (Form 1040) and Schedule D (Form 1040). Brokerage statements provide necessary information. | Selling shares of Apple stock for a profit after holding them for two years. |

| Bonds | Capital gains/losses upon sale, interest income reported annually. | Interest income reported on Schedule B (Form 1040), capital gains/losses on Schedule 8949 (Form 1040) and Schedule D (Form 1040). | Selling a bond at a profit after holding it for three years. |

Capital Gains and Losses

Understanding capital gains and losses is crucial for accurately reporting your cryptocurrency transactions to the tax authorities. The tax implications depend heavily on whether your cryptocurrency holdings are considered short-term or long-term assets, and how you account for transactions and fees.Calculating capital gains and losses from cryptocurrency trading involves determining the difference between the sale price and the original purchase price of each cryptocurrency.

This difference, adjusted for any applicable fees, represents your gain or loss for that specific transaction. The tax treatment of these gains and losses then depends on how long you held the cryptocurrency before selling it.

Short-Term Versus Long-Term Capital Gains

The length of time you hold a cryptocurrency before selling it significantly impacts the tax rate. Short-term capital gains are those realized from assets held for one year or less, while long-term capital gains are realized from assets held for more than one year. Short-term capital gains are taxed at your ordinary income tax rate, which can be considerably higher than the rates applied to long-term capital gains.

Long-term capital gains rates are generally lower and vary depending on your taxable income bracket. For example, in many jurisdictions, long-term capital gains rates are tiered, meaning higher income brackets face higher tax rates on their capital gains, but these rates are still usually lower than ordinary income tax rates.

Wash Sales and Their Tax Consequences

A wash sale occurs when you sell a cryptocurrency at a loss and repurchase substantially the same cryptocurrency within 30 days before or after the sale. The IRS disallows the deduction of losses from wash sales to prevent taxpayers from artificially creating losses for tax purposes. For instance, if you sell Bitcoin at a loss and buy Bitcoin again within 30 days, the loss is not deductible in the current year.

Instead, the loss is added to the cost basis of the repurchased Bitcoin. This effectively postpones the recognition of the loss until a future sale. This rule applies to cryptocurrencies that are considered substantially identical, even if there are minor differences in the exchange or platform where they are traded.

Calculating Capital Gains/Losses: A Step-by-Step Guide

Accurately calculating capital gains and losses requires meticulous record-keeping. Here’s a step-by-step guide, incorporating transaction fees:

- Determine the cost basis: This is the original purchase price of the cryptocurrency, including any fees paid at the time of acquisition. Keep detailed records of all transactions, including date, amount, and fees.

- Calculate the proceeds: This is the amount you received from the sale of the cryptocurrency, net of any selling fees.

- Calculate the gain or loss: Subtract the cost basis (including fees) from the proceeds (net of fees). A positive result indicates a gain, while a negative result indicates a loss.

- Determine the holding period: Calculate the number of days between the acquisition date and the sale date to determine whether the gain or loss is short-term or long-term.

- Report the gain or loss: Report your capital gains and losses on Schedule D (Form 1040) or the equivalent form in your tax jurisdiction. Be sure to accurately classify them as short-term or long-term.

Example: You bought 1 Bitcoin for $10,000 (including fees) on January 15th and sold it for $15,000 (net of fees) on December 15th of the same year. Your long-term capital gain is $5,000 ($15,000 – $10,000). However, if you sold it on February 15th, the gain would be a short-term capital gain.

Mining and Staking

Cryptocurrency mining and staking represent distinct methods of earning cryptocurrency, each carrying its own set of tax implications. Understanding these differences is crucial for accurate tax reporting and compliance. Both activities generate taxable income, but the nature of that income and the associated deductions can vary significantly.The tax treatment of cryptocurrency mining and staking hinges on the classification of the rewards as either ordinary income or capital gains.

This classification, in turn, influences how these earnings are reported and what deductions are allowed. The complexities increase when considering the expenses associated with these activities, such as hardware costs and electricity consumption.

Understanding the tax implications of cryptocurrency trading is crucial for responsible investing. To minimize your tax burden while maximizing returns, a well-informed approach is essential. This involves carefully considering various strategies, including those outlined in our guide on Best crypto investment strategies , which can help you navigate the complexities of the market. Ultimately, a proactive strategy for both investment and tax planning will lead to more successful long-term results in cryptocurrency trading.

Tax Implications of Cryptocurrency Mining

Mining cryptocurrency involves using computing power to solve complex mathematical problems, validating transactions, and adding new blocks to the blockchain. The reward for this computational work is typically a portion of the newly minted cryptocurrency. This reward is generally considered taxable income in the year it is received, and it’s usually treated as ordinary income, similar to wages or salary.

However, the Internal Revenue Service (IRS) has yet to issue specific guidance on the precise tax treatment of all mining activities. Taxpayers should consult with a tax professional to determine the appropriate tax treatment for their specific circumstances. The cost of mining equipment (computers, specialized hardware, etc.) is generally depreciated over its useful life, rather than being expensed immediately.

Similarly, electricity costs incurred during mining are deductible business expenses.

Tax Treatment of Mining Rewards Compared to Staking Rewards

Mining rewards are generally treated as ordinary income, reflecting the active nature of the activity and the provision of services (computational power). Staking, on the other hand, often involves locking up existing cryptocurrency in a wallet or on a platform to support the network’s operations. Staking rewards are generally considered taxable income, but the tax treatment can differ depending on the specific circumstances.

If the staking rewards are considered to be interest income, they might be taxed as ordinary income. However, if the rewards are viewed as a return on investment, they might be taxed as capital gains. The distinction is often blurred and requires careful consideration of the specific staking mechanism and the relevant tax laws. This area is constantly evolving and subject to interpretation.

Understanding the tax implications of cryptocurrency trading is crucial for responsible investing. These implications can vary significantly depending on your trading frequency and strategies; for instance, frequent trading, as often seen in day trading, presents a unique set of tax considerations. To optimize your trading approach, you might find helpful guidance on effective strategies in this resource: Day trading cryptocurrency tips.

Returning to tax implications, it’s always advisable to consult a tax professional for personalized advice to ensure compliance.

Consulting a tax professional is strongly advised.

Reporting Income from Mining and Staking

Income generated from both mining and staking activities must be reported to the tax authorities. The precise method of reporting will depend on the jurisdiction and the nature of the income (ordinary income versus capital gains). Typically, this involves reporting the total value of the cryptocurrency received as income at the fair market value on the date of receipt.

Any expenses incurred in relation to these activities can be deducted to reduce the taxable income. Accurate record-keeping is essential to demonstrate the income earned and the associated expenses. It is crucial to track the fair market value of the cryptocurrency at the time of receipt, as this will determine the amount of income to be reported.

For example, if 1 BTC is received as a mining reward, its value in USD at the time of receipt must be reported. Subsequent changes in the value of BTC do not impact the reported income for that specific mining event.

Common Deductions for Cryptocurrency Mining Operations

A number of deductions may be available to reduce the taxable income from cryptocurrency mining operations. Careful record-keeping is crucial for claiming these deductions.

- Hardware Costs (Depreciation): The cost of mining hardware can be depreciated over its useful life. This allows for a deduction each year, reducing the taxable income.

- Electricity Costs: The cost of electricity used for mining is a deductible business expense. Accurate metering and record-keeping are essential to substantiate this deduction.

- Internet Costs: Internet costs directly related to mining operations are also deductible.

- Software Costs: Costs associated with mining software, including licenses and updates, are deductible.

- Maintenance and Repair Costs: Expenses incurred for maintaining and repairing mining equipment are deductible.

- Home Office Deduction (if applicable): If a portion of your home is used exclusively for mining operations, a home office deduction may be available. This deduction is complex and has specific requirements.

It’s important to note that tax laws are complex and subject to change. This information is for general guidance only, and it is recommended to consult with a qualified tax professional for personalized advice.

Cryptocurrency Payments and Transactions

Using cryptocurrency to buy goods and services or receive payments for business activities introduces unique tax considerations. Understanding how these transactions are treated is crucial for accurate tax reporting and compliance. This section details the tax implications of cryptocurrency payments and transactions, focusing on both the purchase of goods and services and the receipt of cryptocurrency as business income.

Tax Treatment of Cryptocurrency Purchases

When you use cryptocurrency to purchase goods or services, the transaction is treated as a sale of the cryptocurrency. You will realize a capital gain or loss based on the difference between the fair market value of the cryptocurrency at the time of the sale (the time you made the purchase) and its original cost basis. For example, if you bought Bitcoin for $10,000 and used it to purchase a laptop worth $5,000, you would recognize a $5,000 capital gain, assuming the fair market value of Bitcoin at the time of the purchase was $15,000.

The cost basis of the laptop would be $15,000 (the fair market value of the Bitcoin used). If the fair market value of the Bitcoin at the time of the purchase was less than $10,000, you would recognize a capital loss. It is important to accurately record the fair market value of the cryptocurrency at the time of each transaction.

Reporting Requirements for Cryptocurrency Business Income

Receiving cryptocurrency as payment for goods or services constitutes business income. This income must be reported to the tax authorities at its fair market value in US dollars on the date of the transaction. The value should be calculated using the prevailing exchange rate at the time of the transaction. Failure to accurately report cryptocurrency income can lead to significant penalties.

This income is typically reported on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). For businesses structured as corporations or partnerships, the reporting method will vary accordingly.

Tracking and Reporting Cryptocurrency Business Transactions

Accurate record-keeping is essential for correctly reporting cryptocurrency transactions. A detailed log should be maintained for every transaction, including the date, the type of cryptocurrency involved, the quantity, the fair market value in USD at the time of the transaction, the recipient’s details (if applicable), and a description of the transaction. Spreadsheets, accounting software specifically designed for cryptocurrency tracking, or dedicated crypto tax software can facilitate this process.

Maintaining thorough records will simplify tax preparation and reduce the risk of errors or omissions.

Flowchart for Reporting Cryptocurrency Business Transactions

A flowchart can visually represent the process. The flowchart would begin with a “Cryptocurrency Transaction Occurs” box. This would branch to two boxes: “Received as Payment” and “Used for Expenses”. The “Received as Payment” branch would lead to boxes detailing recording the date, amount (in cryptocurrency and USD equivalent), and recipient information. This information is then used to calculate income and report it on the appropriate tax form.

The “Used for Expenses” branch would similarly lead to boxes for recording transaction details and calculating capital gains or losses. Finally, both branches would converge to a “File Tax Return” box, indicating the completion of the reporting process. The entire flowchart emphasizes the importance of detailed record-keeping at each stage.

Tax Reporting and Compliance

Accurate reporting of cryptocurrency transactions is crucial to avoid penalties and maintain compliance with tax laws. The complexities of cryptocurrency necessitate a clear understanding of the reporting requirements and best practices for record-keeping. This section details the necessary forms, potential penalties, and strategies for accurate tax preparation.

Cryptocurrency transactions are generally considered taxable events, similar to trading stocks or other assets. The specific forms and schedules used depend on the nature of the transaction and your overall tax situation. The Internal Revenue Service (IRS) in the United States, for example, considers cryptocurrency as property, not currency, for tax purposes. This means that gains and losses from cryptocurrency transactions are subject to capital gains taxes.

Understanding the tax implications of cryptocurrency trading is crucial for financial well-being. These regulations, often complex, can vary significantly depending on your location and investment strategies; for example, the approach differs greatly from the more established financial systems often associated with American culture. Therefore, seeking professional tax advice tailored to your specific cryptocurrency activities is highly recommended to ensure compliance and avoid potential penalties.

Other countries have similar, but potentially varying, regulations.

Forms and Schedules for Reporting Cryptocurrency Transactions

In the United States, taxpayers typically use Form 8949, Sales and Other Dispositions of Capital Assets, to report the sale or exchange of cryptocurrency. This form details the cost basis, proceeds, and resulting gain or loss for each transaction. The information from Form 8949 is then transferred to Schedule D (Form 1040), Capital Gains and Losses, which is part of the overall tax return (Form 1040).

If you are involved in mining or staking, additional reporting might be required depending on the specific circumstances and the relevant tax laws.

Penalties for Non-Compliance

Failure to accurately report cryptocurrency income or transactions can result in significant penalties. These penalties can include interest charges on unpaid taxes, accuracy-related penalties, and even criminal prosecution in cases of intentional tax evasion. The penalties can vary depending on the severity of the violation and the taxpayer’s history. For instance, a simple oversight might result in interest charges, while intentional misrepresentation could lead to substantial fines and criminal charges.

Best Practices for Maintaining Accurate Records

Maintaining meticulous records is essential for accurate tax reporting. This includes documenting all cryptocurrency transactions, including purchase dates, amounts, and exchange rates. Using a reputable cryptocurrency tracking software or spreadsheet can greatly simplify this process. Storing all relevant documentation, such as transaction confirmations, wallet addresses, and exchange statements, is also critical.

- Maintain a detailed transaction log for every cryptocurrency transaction, including the date, time, type of transaction (buy, sell, trade, etc.), amount of cryptocurrency, and the equivalent USD value at the time of the transaction.

- Utilize a cryptocurrency tax software or spreadsheet to track your transactions and calculate your capital gains and losses automatically. Many such programs are available, offering various features and levels of sophistication.

- Keep all relevant documentation, such as exchange statements, wallet transaction history, and any other records that can support your tax filings. Store these documents securely and organize them efficiently for easy retrieval.

- Consult with a qualified tax professional who specializes in cryptocurrency taxation. They can provide personalized guidance based on your specific circumstances and help you navigate the complexities of cryptocurrency tax regulations.

Preparing a Tax Return Reflecting Cryptocurrency Trading Activities

Preparing a tax return accurately reflecting cryptocurrency trading activities requires careful attention to detail and a thorough understanding of tax regulations. The following steps and documentation are essential for accurate filing.

- Gather all necessary documentation: This includes exchange statements, wallet transaction histories, records of mining or staking rewards, and any other documentation related to your cryptocurrency transactions.

- Calculate your cost basis: Determine the original cost of each cryptocurrency you acquired. This might involve calculating the cost basis for each individual coin based on the purchase price and any fees incurred.

- Determine your proceeds: Record the amount of fiat currency (USD, EUR, etc.) or other assets received from the sale or exchange of your cryptocurrency.

- Calculate your capital gains or losses: Subtract your cost basis from your proceeds for each transaction to determine your gain or loss. Remember that short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate, while long-term capital gains (assets held for more than one year) are taxed at lower rates.

- Complete Form 8949: Report each cryptocurrency transaction on Form 8949, including the date acquired, date sold, proceeds, cost basis, and resulting gain or loss.

- Transfer the information to Schedule D: Transfer the totals from Form 8949 to Schedule D to report your total capital gains and losses.

- File your tax return (Form 1040): Include Schedule D with your Form 1040 to report your cryptocurrency gains and losses as part of your overall tax liability.

International Tax Implications

The taxation of cryptocurrency transactions transcends national borders, creating complexities for individuals engaging in cross-border cryptocurrency activities. Understanding the varying tax laws and reporting requirements across different jurisdictions is crucial for compliance and avoiding potential penalties. This section will explore the key international tax implications of cryptocurrency trading.The tax treatment of cryptocurrency varies significantly depending on the individual’s country of residence.

Some countries treat cryptocurrency as property, subjecting gains to capital gains tax, while others classify it as a currency, leading to different tax implications for transactions. Furthermore, the specific tax rates and reporting requirements can differ widely, even within similar tax systems. For example, the capital gains tax rate on cryptocurrency profits might be significantly higher in one country compared to another, or the reporting requirements might necessitate a far more detailed accounting of transactions.

Tax Laws and Regulations Across Jurisdictions

A comparison of cryptocurrency tax laws across various jurisdictions reveals a lack of uniformity. Many countries are still developing their regulatory frameworks for digital assets, leading to inconsistencies and ambiguities. For instance, the United States treats cryptocurrency as property for tax purposes, meaning gains and losses are subject to capital gains taxes. However, the UK’s approach is slightly different, with the tax treatment dependent on how the cryptocurrency is used.

Similarly, countries like Singapore and Malta have taken proactive steps to establish clearer regulatory guidelines, aiming to foster innovation while maintaining tax compliance. This variation highlights the need for individuals to thoroughly research the specific tax laws of their country of residence and any other jurisdictions where they conduct cryptocurrency transactions.

Tax Liabilities for Cross-Border Transactions

Cross-border cryptocurrency transactions introduce additional complexities. The exchange of cryptocurrency between individuals in different countries can trigger tax liabilities in both jurisdictions. Determining the applicable tax laws and ensuring compliance with reporting requirements in multiple countries can be challenging. For example, if a US resident trades cryptocurrency on a foreign exchange, both US and the foreign country’s tax laws might apply, depending on the specific circumstances.

This often necessitates meticulous record-keeping and potentially professional tax advice to navigate the intricacies of international tax law.

Reporting Cryptocurrency Income Earned from International Sources, Tax implications of cryptocurrency trading

Reporting cryptocurrency income earned from international sources can be particularly intricate. Individuals need to comply with both the reporting requirements of their country of residence and any relevant reporting obligations in the countries where the income originated. This often involves documenting all transactions, including the date, amount, and relevant exchange rates, to accurately calculate taxable income. Furthermore, the complexities are amplified by the potential need to file tax returns in multiple jurisdictions, each with its own specific forms and deadlines.

The lack of standardized reporting mechanisms across different countries further complicates the process, necessitating a comprehensive understanding of each country’s specific regulations.

Tax Implications of DeFi Activities

Decentralized finance (DeFi) offers innovative ways to interact with cryptocurrencies, but navigating the tax implications of these activities can be complex. Understanding how different DeFi interactions are categorized for tax purposes is crucial for accurate reporting and compliance. This section will explore the tax treatment of common DeFi activities, focusing on lending and borrowing, yield farming, and the challenges of tracking these transactions.

Tax Implications of Lending and Borrowing Cryptocurrency

Lending and borrowing cryptocurrencies through DeFi platforms generate taxable events. When you lend cryptocurrency, you are essentially providing a loan, and any interest earned is considered taxable income. Similarly, borrowing cryptocurrency incurs interest expenses, which may be deductible depending on your specific circumstances and tax jurisdiction. The interest earned is generally taxed at your ordinary income tax rate, while interest paid may be deductible against your other income, subject to limitations.

For example, if you lend 1 BTC and receive 5% annual interest in a stablecoin, the value of that stablecoin interest received is considered taxable income. Conversely, if you borrow 1 ETH and pay 10% annual interest in ETH, the value of the ETH paid as interest is a deductible expense, subject to relevant tax laws.

Tax Treatment of Yield Farming and Staking Rewards

Yield farming and staking within DeFi ecosystems involve providing liquidity or locking up your cryptocurrency to earn rewards. These rewards are generally considered taxable income at the time they are received. The value of the rewards at the time of receipt is used to determine the taxable amount. This is true regardless of whether the rewards are paid in the same cryptocurrency or a different one.

For example, if you stake 100 DAI and receive 5 DAI in rewards, the value of those 5 DAI at the time of receipt is taxable. Similarly, if you participate in a yield farming pool and receive 0.1 ETH as a reward, the value of that 0.1 ETH at the time of receipt is taxable income.

Challenges in Tracking and Reporting DeFi Transactions

Tracking and reporting DeFi transactions presents unique challenges. The decentralized and pseudonymous nature of many DeFi platforms makes it difficult to obtain comprehensive transaction records. Many platforms do not automatically provide tax reporting information, unlike traditional financial institutions. Furthermore, the frequent and complex nature of transactions, including automated compounding and impermanent loss, requires careful record-keeping and potentially specialized tax software to accurately calculate gains and losses.

The constantly evolving DeFi landscape also adds to the complexity, with new protocols and mechanisms emerging regularly.

Examples of Categorizing DeFi Activities for Tax Reporting

Accurate categorization is key to proper tax reporting. For example, lending cryptocurrency on a DeFi platform generates taxable interest income. Yield farming rewards are also considered taxable income, often categorized as “other income”. Providing liquidity to a decentralized exchange (DEX) can result in taxable gains or losses depending on the price fluctuations of the assets provided. Staking rewards are treated similarly to yield farming rewards, as taxable income at the time of receipt.

It’s crucial to maintain detailed records of all transactions, including dates, amounts, and cryptocurrency values at the time of each transaction, to accurately report these activities. Using specialized cryptocurrency tax software can significantly simplify the process.

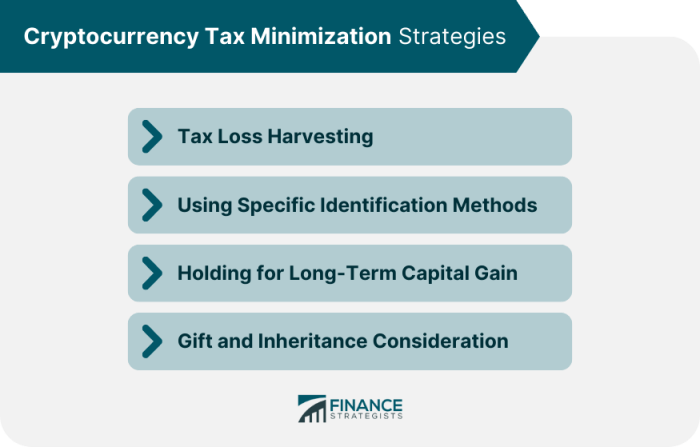

Gifting and Inheritance of Cryptocurrency

Source: financestrategists.com

Gifting or inheriting cryptocurrency carries significant tax implications for both the giver and the recipient, varying considerably depending on the jurisdiction and the specific circumstances. Understanding these implications is crucial for proper tax planning and compliance. The key factors determining the tax liability revolve around the fair market value of the cryptocurrency at the time of the gift or inheritance.

Tax Implications of Gifting Cryptocurrency

When gifting cryptocurrency, the giver generally incurs a capital gains tax on the difference between the cryptocurrency’s fair market value at the time of the gift and its original cost basis. This means if the cryptocurrency has appreciated in value since the giver acquired it, they will owe taxes on that appreciation, even though they haven’t sold the asset.

The recipient, on the other hand, typically receives the cryptocurrency with a new cost basis equal to the fair market value on the date of the gift. This means their future capital gains or losses will be calculated from that point forward. Gift tax rules may also apply, depending on the value of the gift and the applicable gift tax thresholds in the giver’s jurisdiction.

These thresholds vary widely internationally. For instance, in the US, the annual gift tax exclusion allows for a certain amount of gifting without incurring a gift tax. However, gifts exceeding this limit may require filing a gift tax return.

Tax Consequences of Inheriting Cryptocurrency

Inheriting cryptocurrency differs significantly from receiving it as a gift. The recipient inherits the cryptocurrency with a stepped-up cost basis. This means the cost basis is adjusted to the fair market value of the cryptocurrency on the date of the decedent’s death (or the alternate valuation date, if applicable). This eliminates any capital gains tax liability for the inheritor at the time of inheritance.

However, when the inheritor eventually sells the cryptocurrency, they will pay capital gains tax on the difference between the selling price and the stepped-up basis. Importantly, the inheritor must still report the inherited cryptocurrency on their tax return, even if there is no immediate tax liability.

The Role of Fair Market Value

Fair market value (FMV) is the price at which a willing buyer and a willing seller would transact in an open market, neither being under any compulsion to buy or sell. Determining the FMV of cryptocurrency can be challenging due to its volatility. Generally, the FMV is determined by referencing reputable cryptocurrency exchanges and considering the average price over a specific period, potentially adjusted for trading volume and other market factors.

Understanding the tax implications of cryptocurrency trading is crucial for responsible investing. The complexities involved can be surprisingly significant, especially considering the volatile nature of the market; for a different kind of volatility, you might find yourself interested in predictions for American movies 2025 , which offer a different type of investment and market analysis. Returning to cryptocurrency, proper record-keeping and professional advice are highly recommended to navigate the tax landscape effectively.

Accurate FMV determination is crucial for both gifting and inheritance scenarios as it directly impacts the calculation of capital gains taxes for the giver and the cost basis for the recipient. Using inaccurate FMV can lead to significant tax penalties.

Tax Differences Between Gifting and Inheriting Cryptocurrency

| Feature | Gifting Cryptocurrency | Inheriting Cryptocurrency |

|---|---|---|

| Giver’s Tax Liability | Capital gains tax on appreciation since acquisition. Potential gift tax liability depending on gift value and applicable thresholds. | No capital gains tax at the time of inheritance. |

| Recipient’s Cost Basis | Fair market value at the time of the gift. | Fair market value at the time of death (or alternate valuation date). |

| Future Tax Implications for Recipient | Capital gains or losses calculated from the fair market value at the time of the gift. | Capital gains or losses calculated from the fair market value at the time of death (or alternate valuation date). |

| Reporting Requirements | Giver may need to file a gift tax return; recipient reports the cryptocurrency at its fair market value at the time of the gift. | Recipient reports the cryptocurrency at its fair market value at the time of death (or alternate valuation date). |

Concluding Remarks

Source: forexbrokerlisting.com

Navigating the tax implications of cryptocurrency trading requires a thorough understanding of the unique aspects of this asset class. While the complexities can seem daunting, a proactive approach to record-keeping and a clear grasp of the relevant tax regulations are essential for minimizing liabilities and ensuring compliance. By carefully tracking transactions, understanding the different tax treatments for various cryptocurrency activities, and seeking professional advice when needed, individuals and businesses can effectively manage their tax obligations in this rapidly evolving space.

Staying informed about updates to tax laws and regulations is also critical to maintaining compliance in the long term.

Answers to Common Questions: Tax Implications Of Cryptocurrency Trading

What are the tax implications of losing my private keys to my cryptocurrency?

The loss of private keys is generally considered a capital loss for tax purposes, provided you can demonstrate the loss and its value at the time of loss. You would need to report this loss on your tax return according to your jurisdiction’s specific regulations.

How do I determine the fair market value of cryptocurrency for gifting purposes?

The fair market value is typically determined by the price at the time of the gift. It’s advisable to use a reputable cryptocurrency exchange’s price at the time of the transaction as evidence of fair market value. You may need to consult a tax professional for more complex scenarios.

Are there tax implications if I receive cryptocurrency as a payment for services?

Yes, cryptocurrency received as payment for services is considered taxable income. You must report this income on your tax return at the fair market value of the cryptocurrency at the time of receipt. The tax treatment will depend on your specific circumstances and jurisdiction.

What happens if I fail to report my cryptocurrency transactions?

Failure to report cryptocurrency transactions can result in significant penalties, including interest and fines. In some cases, criminal charges may also be filed. Accurate and timely reporting is crucial to avoid these consequences.